WWE is known for ” purely entertainment-based, featuring storyline-driven, scripted, and choreographed matches, though matches often included moves that can put performers at risk of injury if not performed correctly.”

I thought that outline was fitting for what is currently happening in our macroeconomy.

I’ve done a couple of pieces like this before – a general market update, a way to stay engaged and plugged into what is going on. This one is more speculative than usual. There is an absolute barrage of overwhelming information out there, and its hard to make sense of it all.

But that’s why Scanlon on Stocks exists – to help that information seem a little bit less overwhelming.

One thing that I’ve done a lot of research on during the past few weeks is currency valuation.

The US Dollar. The Greenback. The Buck. The Paper. The Benjamins.

No matter what you call it, it is determined by several different variables (expectations, term premiums, interest rates, fiscal balances, national savings, and demographics to name a few)

And it’s a fiat currency, meaning that it actually derives its value from the “full faith and credit in the government“.

The DXY (index that measures the dollar) gone up 6% since the beginning of the year due to several macroeconomic variables. It’s third in value only to Switzerland and Sweden according to the most recent Big Mac Index.

Because we aren’t tied to anything, there are opportunities to manipulate the value of the currency to take it in the direction people think it should go. When we were taken off the gold standard, the printing press became a way for us to manipulate the value of our currency.

And other countries can do the same. For example, China is really good at currency manipulation.

China is also a powerhouse.

We rely on them for a lot of our goods, and our economies are quite intertwined.

The US owes China a lot of money. And China doesn’t really owe the US much of anything, in terms of trade.

The deficit has gotten worse over time.

These images just give you an idea of the discrepancy of trade. And I don’t think this is a bad thing. I believe in the idea of comparative advantage – China can produce things cheaper and quicker than we can, and it makes perfect economic sense for the US to take advantage of that.

“Trade deficits are not a sign of unfair trade practices or of a lack of American competitiveness” as Daniel Griswold of the Cato Institute wrote. America is a net importer of capital, and those dollars spent on foreign goods in theory get invested into American assets in the form of T-bills, stocks, real estate etc, which should in theory boost the capital account, and thus in theory boost the economy.

And Griswold also said “Slapping higher tariffs on imports will only deprive foreigners of the dollars they would have earned by selling in the U.S. market.”

My first semester freshman year, I had my first econ class that sparked the beginning to my interest in the field.

One day, we were discussing trade, talking about comparative and competitive advantages. The topic of tariffs and quotas and other things that block trade flows came up, and my professor climbed up onto the tables and shouted “Free Trade Creates Wealth”.

That sentence has stuck with me since then for reasons other than the mental snapshot of my professor standing on a table at the front of class.

It has stuck with me because he is right.

Free trade does create wealth. Taxation on imports (tariffs) do not, just like Griswold said. It takes away jobs, it can create a rise in domestic prices, and creates general discontent across the board.

For example, the Bush Tariff (2002):

- 200,000 Americans lost their jobs, with “more Americans losing their jobs in 2002 to higher steel prices than the total number employed by the US steel industry itself.” (Forbes, 2016)

The economy took a $30b hit. Allies were upset. Industries took a hit. As Carlos Gutierrez, Bush commerce secretary said “What we have learned over the years is that protectionism doesn’t protect. Protectionism actually harms.”

Why would you repeat this blunder?

But this time around, Trump declared under Section 232 which considers that there is a national secretary threat on imports. Bush used 201, which was an investigation of industries that could potentially need safeguarding from imports.

Two very, very different things. Bush was a lot less severe. Trump, not so much.

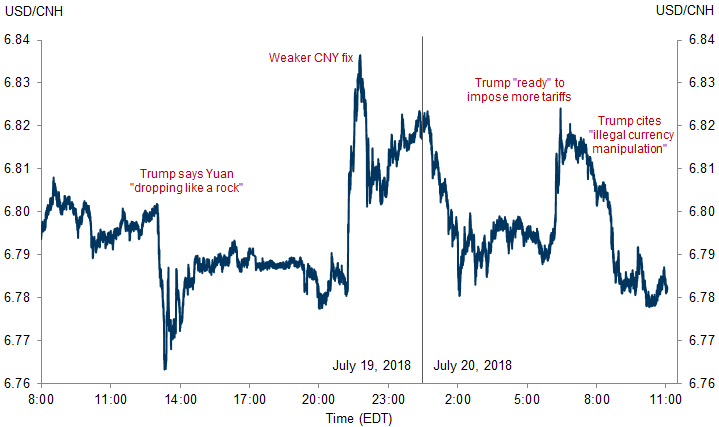

And China is definitely showing their discontent with the tariffs we’ve enacted on them. They are lowering the reminbi for several reasons, one of them to potentially curb the impact of the tariffs.

But China is strong.

China is expected to surpass the US in terms of GDP. After all, “China is unique“. They export products to almost every single country, and have EM Asia on a hook. Take a look at the Belt and Road Initiative.

They are developing “a whole China-centered trading network”, and the US is not invited.

They also own a LOT of US debt. This could be problematic, especially if they chose to release the debt.

Like I said, a powerhouse. With quite a few economic weapons on their hands.

And they know how to manipulate their currency to make it hurt.

So we have some trade tensions and some currency tensions and geopolitical tensions to add to the giant global tension super battle we are currently creating. Might as well throw some chairs at each other at this point.

The USD/CNY has fallen 8% over the past 3 months. Essentially, China is loading their weapons. They are showing the world that they are ready for this fight.

And this strategy makes sense.

Back in 2015/2016, China devalued their currency, which decimated global growth around the world.

The SP 500 fell by 6.1% that August. EAFE fell 7.4%. EMs fell 8.8%. Volatility went through the roof (great time to sell some options!)

Emerging market volatility rose 75%, Developed market volatility rose 67%, and China volatility rose 50%. The VIX (SP 500 volatility index) rose a sparkling 143%.

So to say that we are a globalized economy, and what China does with their currency matters is quite a bit of an understatement.

The market has been showing incredible strength under Trump’s presidency, but he himself has developed into an entire variable.

And what he says matters.

Trump recently came out and criticized a stronger dollar, citing that China and other countries were manipulating their currencies and taking away our “big competitive edge“.

He also criticized interest rate hikes, directly going after the Federal Reserve (yikes).

Both statements were a way of saying “The dollar is too strong.”

And the dollar reacted, with the DXY dropping 0.72% by the end of the day.

But despite that, the dollar is still up 6% from lows of this year. And it should be.

There is a continuous cycle of news that tells us how great things are:

- Fiscal stimulus in the form of tax cuts.

- Rate hikes.

- Record “low unemployment”.

- Low jobless claims.

- GDP growth.

- “Good inflation numbers”.

- 90% of US companies beating earnings by 4.5% on average

Even if none of it is actually a good thing (or quite true, ie. measurement of unemployment) it all combines into this big pot that should influence investor sentiment positively.

But if China keeps devaluing their currency to maintain their export volume because of the tariffs enacted on them, none of those things will matter.

It will create a global ripple effect and create weakness across all markets.

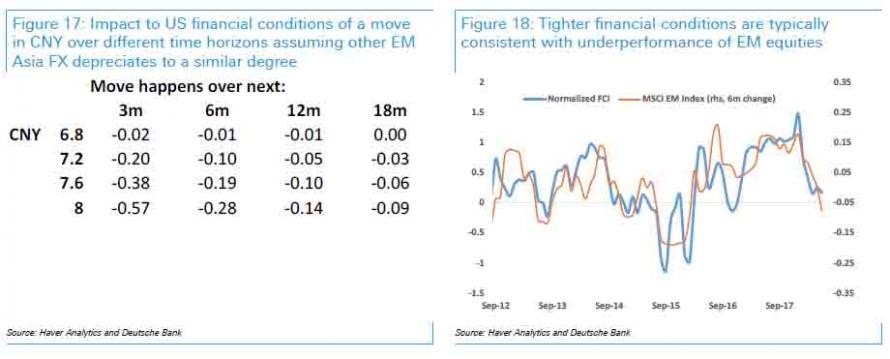

According to the above Deutsche Bank analysis, if the USD/CNY moves to 8 (it is currently at 6.76, so it would be a huge move) the US financial conditions will see a contraction of 0.57 points.

The deterioration of financial conditions as a result of reminbi devaluation would result in an equivalent Fed easing of 55 bps. Two rate cuts.

And we really just started raising rates.

Take the above graphs with a grain of salt, of course. But the thesis is that if China continues to devalue their currency, the US will be in trouble.

Starting a currency war with a global powerhouse (China being the global powerhouse) is not a good thing.

If a continuation in devaluation and a Fed intervention did happen (extrapolating here), it would result in a systematic shock, pushing the dollar down even more and a flight from equities into bonds, which would subsequently push the market down.

If the Fed didn’t move rates, China would continue to engage in currency devaluation, which would result in quite a few problems for our markets.

Either way, it would be a realization – there are no winners in a trade or currency war.

Maybe we could just not place tariffs on our biggest trading partner. Or maybe not combine fiscal stimulus and rate hikes all at once.

And maybe not make that trade war evolve into a currency war.

Just a thought.

Leave a comment