(On the right side is Simon Warshaw and on the left side is Michael Zaoui)

While it’s normal that big name players take mega deals in M&A market, small investment bank boutiques in London have shared a bigger slice of the pie than ever before, and, many times, some of them are beating big names.

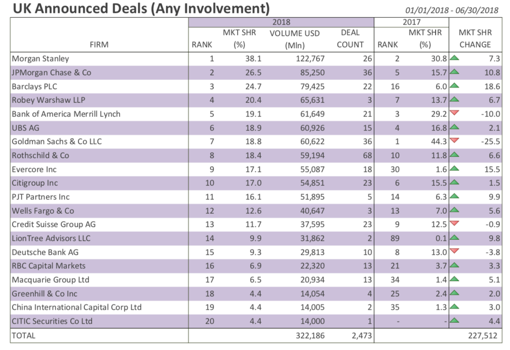

Robey Warshaw, a Mayfair based investment bank boutique with merely 13 members, had a market share of 20.4% and an announced deal volume of about $65.6 billion through 1H2018 in the UK M&A market, according to the Bloomberg Global M&A Market Review 1H2018, overcoming giants such as Bank of America Merrill Lynch ( UK market share19.1%, deal volume: $61.6 billion), Goldman Sachs (UK market share: 18.8%, deal volume: $60.6 billion) and Rothschild (UK market share: 18.4%, deal volume: $59.2 billion) etc.. Interestingly, Robey Warshaw had only 3 deals to achieve a deal volume as high as $65.6 billion, comparing to an average of approximately 30 deals for other top-10 investment banks on this list (as shown in the table). With an average deal size of $21.9 billion,Robey Warshaw beat almost every company on this criterion.

Another mega-deal investment bank kiosk is Zaoui & Co. Established in 2013 by Morocco-born brothers, Michael Zaoui and Yoël Zaoui, Zaoui & Co had 12 employees in 2015, of which only 7 were bankers. It is worth noting that both brothers held a senior role in major investment banks: Michael was the head of M&A division at Morgan Stanley and Yoël at Goldman Sachs. Although the company was not on the top 20 deal-maker list in the 1H2018 report, which is mainly due to a lack of large deals and a nearly 60% shrink in French M&A market, according to Michael Zaoui’s interview with Financial News, it showed a strong performance in 2014 and 2015, only two years after it was incorporated. In 2014, the company advised GlaxoSmithKline PLC (“GSK”) to acquire 36.5% of stake in Consumer Healthcare Joint Venture of Novartis AG (“Novartis”) for $13 billion. There are other transactions involved which push the total amount to $57 billion. The deal was closed on 1st June 2018. In the same year, Zaoui brothers also advised a major merger in the manufacturing industry, helping Lafarge and Holcim to form LafargeHolcim, now the industry’s biggest player. The transaction involved is about €40 billion. Different from Robey Warshaw, which mainly puts its focus on the UK M&A market, Zaoui & Co. has broader geographical coverage. It has been developing its market in France, Italy, and Switzerland and also working on deals in Israel, according to the Financial News.

Comparing to the similar size UK kiosk advisors (another name often used for investment bank boutiques), which often have deals with transaction volume between $10-300 million, these two investment bank boutiques had an eye-catching performance, often with multi-billion deals. Reason? Their owners were superstars in big-name investment banks long before building their own businesses. Robey Warshaw has a team with Sir Simon Robey, Philip Apostolides, and Simon Warshaw. Sir Simon Robey was the former co-head of global M&A at Morgan Stanley, while Mr. Apostolides also held a senior investment banking role at the same bank. Mr. Warshaw was the former head of investment banking at UBS, according to FT source. Michael Zaoui was a colleague of Simon Robey in Morgan Stanley for many years; even now, their offices in Mayfair are merely a few hundred meters away. While both were co-head of global M&A in Morgan Stanley, Simon Robey focused more on the UK deals while Michael on continental European ones. This is correspondent to the different geographical exposure and strategies of Robey Warshaw and Zaoui & Co now. The former did the most of deals in the UK while the latter focuses primarily on continental Europe. Yoël Zaoui had spent about 25 years in Goldman Sachs and left as the head of the global M&A before founding the company with his brother in 2013. There is “fantasy football team” of London’s leading merger & acquisition advisers on the wall in Zaoui & Co’s boardroom, drawn up by a financial journal, according to EveningStandard. In goal is Karen Cook. The right full-back is Simon Robey. At right center is Richard Gnodde. Occupying the two striking positions are Michael and Yoel Zaoui. When all-star players team up, no wonder they can hit the goal that even big banks cannot.

Robey Warshaw and Zaoui & Co. are just two typical examples of investment bank kiosks. LionTree Advisors LLP (example transaction: Liberty Global’s acquisition of Virgin Media, $23.3 billion) and many others are advising multi-billion deals with just a few bankers in the office. Nonetheless, M&A advisory was never a labor-intensive industry. Thanks to their structure, top tier boutiques can generate an incredible amount of profits with small teams. Zaoui & Co, for example, earned an approximate £17.3 million turnover and an £8.6 profit. Between these two numbers is an administrative expense of £6.4 million, and employee cost was more than £5.3 million for a total of 13 staffs. In conclusion, with a strong network of the top management and an experienced team loaded with talents who worked for big banks, these firms have proven the ability to win the trust from big clients and play a leading role in the most relevant deals in the market.

Autor: Yintao Hu

Sources:

- Financial News, Sahloul F., 28 Sep. 2018 “Zaoui brothers back in black after European M&A bounce” url: https://www.fnlondon.com/articles/zaoui-brothers-back-in-black-after-european-ma-bounce-20180921

- Financial News, Clark P., 8 Oct. 2018 “Deals dry up for Vanity Fair cover stars Zaoui & Co” url: https://www.fnlondon.com/articles/deals-dry-up-for-vanity-fair-cover-stars-zaoui-co-20181008

- Financial Times, Murphy H., 4 Jan. 2018 “Robey Warshaw pays out more than £60m to founders” url: https://www.ft.com/content/ae701f18-f14c-11e7-ac08-07c3086a2625

- Evening Standard, Blackhurst C., 4 Sep. 2015 “Michael Zaoui: The Ronaldo of investment bankers with $150 billion of deals in the back of the net” url: https://www.standard.co.uk/business/michael-zaoui-the-ronaldo-of-investment-bankers-with-150-billion-of-deals-in-the-back-of-the-net-a2927466.html