So Much For Vacation?

Canceled playdates. Suspended daycare. Chuck E. Cheese birthday party—poof! Our personal universes have shrunk immeasurably in the age of the coronavirus, as we confine ourselves to our homes and running only the most essential errands. If you’re like me, you probably aren’t visiting your neighbors down the street, let alone imagining a sun-drenched vacation in the Virgin Islands.

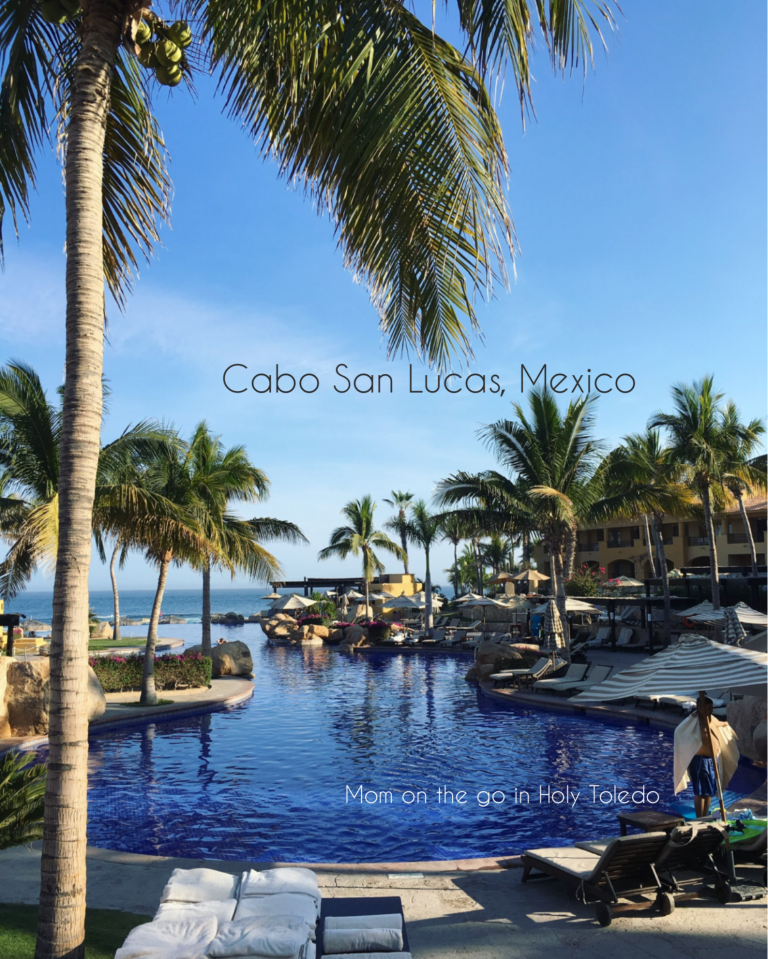

Which is, when you think about it, extra-ironic for a Mom On The Go. But actually, we’re a nation on the go. In 2019, people took a whopping 2.3 billion trips and 1.9 billion of them were for pleasure. Someday soon, life will return to normal. We will vacation again! But if the coronavirus has taught us anything at all, it’s that plans can go awry. That’s why, next time I book a family vacation, I’m thinking of buying travel insurance.

While looking around for the best travel insurance, I learned a couple of things. A four-night domestic vacation costs an average of $1306 per person and way more if you travel internationally. The cost of a travel insurance policy is pretty tiny compared to what you’re likely to spend on leisure travel. So let’s take a look at what the best travel insurance can do.

Cancellation coverage is the biggie. It covers all the non-refundable deposits you pay to arrange your trip. Airfare is usually the high-ticket item here, but the others can add up too. Cancellation coverage kicks in if you or your travel service providers have to cancel your trip due to health emergencies and illnesses or natural disasters. Other covered events often include job loss, labor strikes that make travel impossible, and theft or loss of your passport. Each policy is different, of course—and some travel insurers offer options you can add to non-standard coverage to suit the details of your vacation. For example, you can buy specific event coverage. If you’re heading to New York City with ballet tickets in hand and the performance is canceled, you can cancel or postpone your trip and expect to be reimbursed for your non-refundable purchases including hotel deposits, convention tickets (any Trekkie moms and kids out there?), airport shuttle fees, and more.

Interruption coverage is similar to cancellation coverage, but it covers you when your trip has already begun. In the event of an emergency, you can come home, then resume your trip when your troubles subside.

While most policies do limit the circumstances under which they’ll reimburse you, you can purchase Cancel for Any Reason (CAR) coverage. It’s expensive but if you’re a confirmed non-gambler, it may be the way to go. You can cancel because you have an important meeting you don’t want to miss. Or your kids cross that one non-negotiable boundary and you just don’t want to reward them with a trip to Sesame Place.

If you plan on traveling outside the US, you may also want to consider adding medical coverage to your travel insurance policy. Many domestic health plans restrict their coverage abroad. Medicaid doesn’t provide any international health benefits. And as you know, healthcare is expensive. A lengthy hospital stay can cost far more than your entire vacation. Medical travel insurance coverage is typically very comprehensive and will reimburse you for doctor’s visits, ambulance transport, testing and other forms of evaluation, treatment, and even dental emergencies.

Auto coverage also makes sense if you are traveling abroad, where your own auto policy and credit card providers typically won’t provide the same coverage you get domestically.

I don’t know about you, but while I’ve been stuck at home, I’ve learned about a bunch of new things. And I’m trying to focus on the future, when I can indulge my wanderlust once again. Keep your chin up—and your dreams alive—Toledo moms! And we’ll see each other again when it’s safe out there.