Scott Sumner has an interesting post. The summary:

To summarize, recent market weakness is very easy to explain. The markets believe that the BoJ needs to do more, and they had previously assumed that the BoJ had a “whatever it takes” approach. Now they aren’t so sure. The US stock market doesn’t believe (as strongly) that the Fed needs to do more, but they are strongly opposed to the Fed doing less.

As always; “It’s about expectations of the future policy path, stupid.”

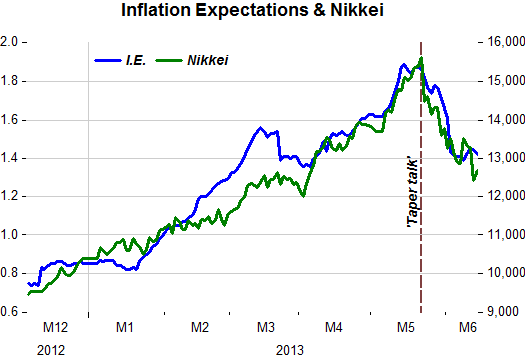

Note how important the US is for other markets. OK that at around the same time as Bernanke ‘messed-up’ with ‘tapering’, in Japan, as noted by Lars Christensen, officials showed worry about the rise in the long yield. The result of these ‘undesirable’ official statements is illustrated below:

In Japan the stock market took a beating, clearly related to the BoJ´s show of reluctance and the Fed´s introduction of ‘taper mania’.

When will they ever learn?