The State of California and the SEIU have agreed to a new contract. I thought you should know just how generous your elected representatives have been with your tax money. Some details have not been made public yet but here’s what we know.

Wages

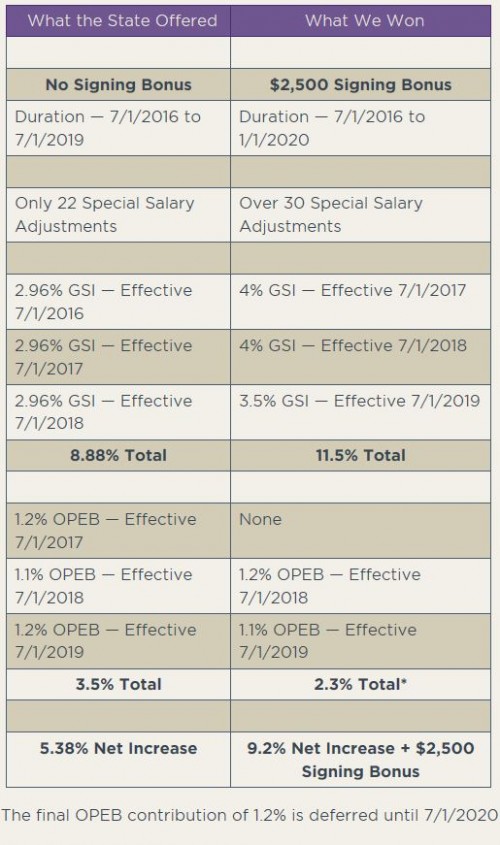

During negotiations, SEIU claimed they wanted a 21 percent increase over three years. As usual, they settled for a fraction of that amount. On the face of it, they claim they got 7 percent over three years. Each increment of this raise takes effect July first (the first day of the new fiscal year.) Actually, it’s less than that.

Two reasons why.

First, a few years back, the State created a new deduction taken from the paychecks of current state workers. This money is to go into a fund earmarked for future retiree medical benefits (sounds vaguely like the Social Security Trust Fund to me.) This fund is incremented over a period of four year and will rise to 3.5 percent of gross pay. The last increment will take effect July 1, 2020. It will go up another 1.2 percent. (see chart below)

Thus the 2.5 percent pay increase July 1, 2020 will actually be a 1.3 percent increase in take home pay (less all the payroll taxes on 2.5 percent “increase”).

Second, the pay increase for the third year, also scheduled to be 2.5 percent may not happen. During negotiations, the State was asking that they be given the right to forego this increase in the event of an economic downturn. Based on the information released thus far, it is unclear if the union agreed to this provision and if so, what the trigger to stop the pay raise will be.

Thus, the actual pay raise over three years may very well be only 3.3 percent; a far cry from the 21 percent the union claimed they were asking for.

Medical Tweak

The union claims that they got $260 a month for anyone on a State sponsored healthcare plan. This is to cover the employee contribution to healthcare. Thus, if only the employee is on the health plan, they would have no employee contribution any more. Once this is implemented, the state would pay 100 percent for individuals.

My question is this, currently my contribution to Kaiser is about $125 a month. Will the state really give me the whole $260 or just pay the $125 and call it good. Oh, for those of you in the private sector, sorry; I know you’re paying lots more than that out of pocket for your share of health insurance.

Geographic Pay

If a state employee lives in any of the following counties: Orange, Santa Barbara, San Luis Obispo, and Santa Cruz, they will also get a geographic differential of $250 each month.

As we know as conservatives, when a government creates a new benefit, over time it will grow to cover more folks. Geographic Differential pay is such a thing. I was surprised not to see a single San Francisco Bay Area county on this list. This is even more reason to suspect that this new benefit will expand over time.

Concluding Remarks

My observation of this contract is this; it appears that all these extra pay things added to the wages of State employees help the State by not boosting employee retirement (assuming retirement is based solely on salary) while easing the pain of living in such a costly State as California. This seems to be the gentleman’s agreement with the State.