A recent article in the Austin American-Statesman (Austin’s roaring rents, August 12,2019) prompted me to update a topic I haven’t commented on for a few months. As the article says, job and population growth in the Austin area continue to outpace the addition of housing, and as a result apartment rents are rising.

In my last post on a related topic, I noted:

” … permits were approved for almost 60,000 dwelling units in 5-plus family structures between 2012 and 2017. That growing supply has slowed increases in apartment rents, which in turn retarded rent increases in the 1-to-4 family space. Rents simply have not been able to increase as quickly as sales prices.”

Housing affordability in the Austin area

It is true that rents have continued to rise in recent years, and reaching a new record isn’t too surprising, but you’ll see in the charts below that the increases, on average, aren’t as steep as the growth in property sale prices. As demand pushes rents upward it affects all property types, some more than others, but the cost of renting will continue to rise until supply meets demand. Increasing supply will require investments in more rental inventory. To explore that I’ll focus today on single family homes and the investors’ perspective.

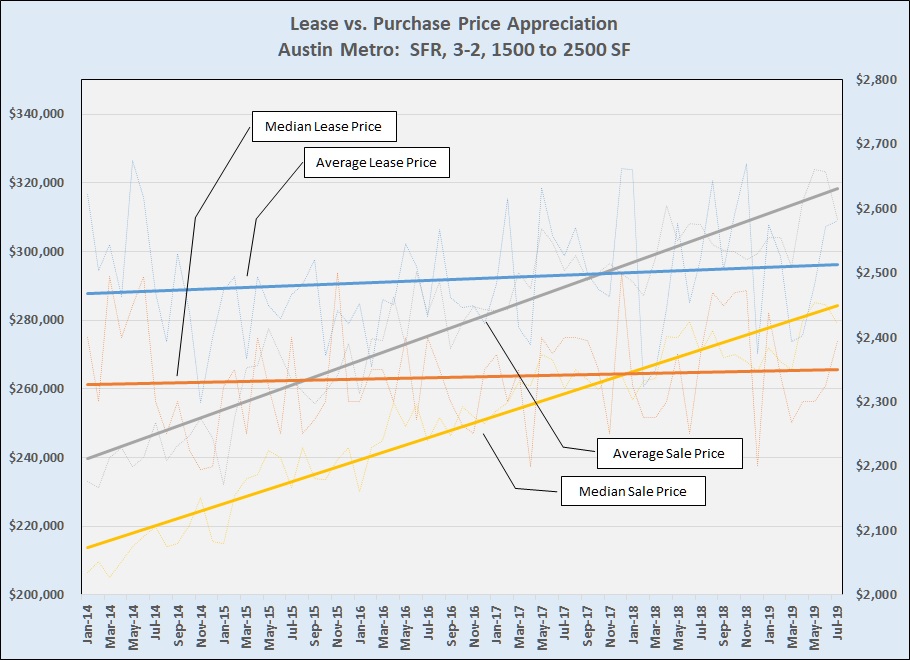

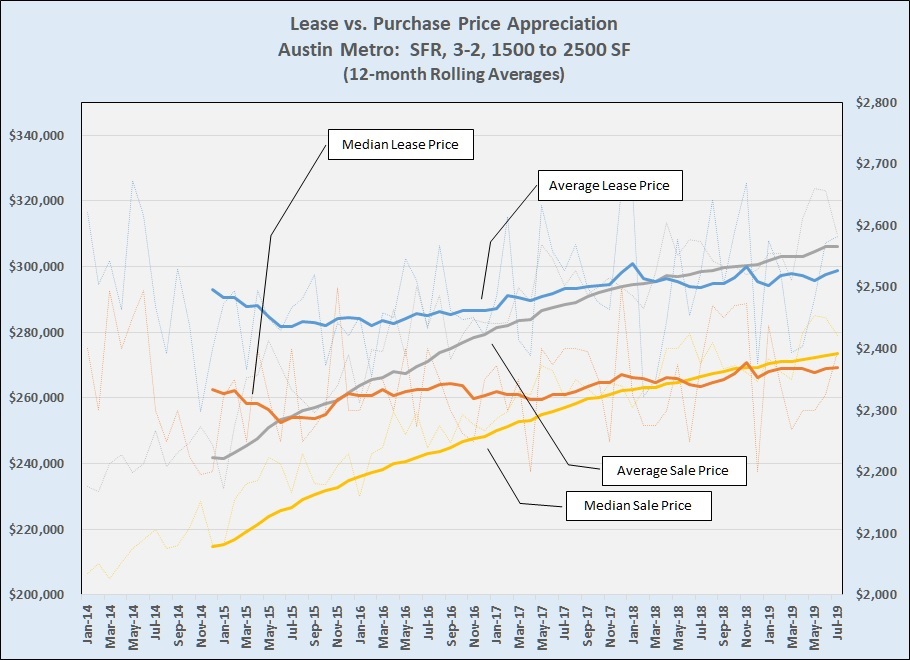

I have written frequently about the rise of sale prices in the area, and I have noted that annual price appreciation continues but has slowed compared to 2013, 2014, and 2015 (First-half 2019 Market Performance). With that in mind, let’s compare the pace of change over the past 5-plus years in sale prices and rents for single family homes. To make this information reasonably relevant, I chose to work with a fairly narrow market segment: houses with 3 bedrooms and 2 baths, 1500 to 2500 square feet in size, across the 5-county metro area. Here are the results:

I used straight-line trends in the first chart to emphasize the difference, but using the moving averages shows the same situation: Average and median sale prices have risen quickly in recent years, while median rents for houses have remained almost flat and average rents have increased only a little.

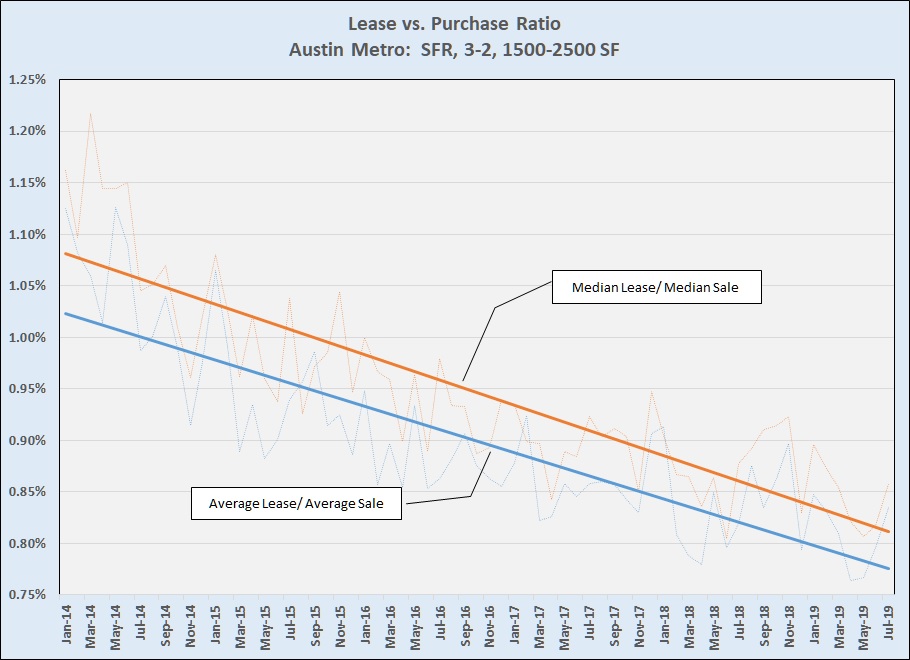

For investors, earning a return is crucial. There are many metrics used in judging the viability of real estate investments — Capitalization Rate, Return On Investment, Internal Rate of Return, and Gross Rent Multiplier are some. As a quick and easy yardstick, many investors just compare the ratio of the rental income to the purchase price, and you can see that that picture isn’t good from the investors’ viewpoint:

On average, the opportunity for profitable investing in the Austin area is more challenging than it was a few years ago. Does that mean that the time for investing in Austin is over? Absolutely not! Selecting the right property in the right location has always been critical, and remains so. Specific areas and neighborhoods offer better opportunities than others, but every investor has to make his or her own decisions about acceptable risk, target demographics, property management and maintenance costs, etc. The market environment now requires more careful analysis of costs and potential benefits than in years past.

At the same time, as apartment rents continue to rise the ceiling for single family home rents should rise as well, assuming businesses in the Austin area continue to create high-paying jobs. The addition of more varied types of housing would help to increase access to relatively affordable inventory, but land use policies in Austin and some surrounding communities make that challenging. The data presented above makes it obvious that adding to our housing stock must happen, though, whether it is houses or apartments, duplexes or fourplexes, or types of moderate-density townhomes and condominiums, and even cooperative housing that is almost nonexistent here now.

Discussion

Trackbacks/Pingbacks

Pingback: Investing in Austin? | Bill Morris on Austin Real Estate - July 11, 2020

Pingback: Investors’ calculations have changed | Bill Morris on Austin Real Estate - August 23, 2021