Royal Dutch Shell plc (ticker: RDS.B) is incorporated in England and Wales and serves as the parent company for Shell, a global group of energy and petrochemical companies. Shell has a global presence in both the upstream and downstream business with operations in more than 70 countries. The company sold 19.6 million tons of equity LNG during 2013 and is currently producing 3.2 MMBOEPD. Shell held a Management Day in London on March 13, 2014, to outline its future endeavors.

Struggles in the Americas

Shell pinpointed the upstream and downstream projects in the Americas as its two focus areas in 2014. The company boosted its rig count and capital expenditures in the region in 2011, but revenue from United States operations has since dropped by 21% to $72.5 billion, according to Shell’s 2013 Annual Report. Shell has now lost roughly $0.9 billion in its upstream Americas division since investing in its development since 2011.

Ben van Beurden, Chief Executive Officer of Shell, said the two businesses had the largest drag on Shell’s profitability in 2013. U.S. operations provided only 16.1% of the company’s revenue in 2013 – down from 19.6% in both 2012 and 2011.

“We have some $80 billion of capital employed combined in Oil Products and North Americas Resources Plays,” said van Beurden. “And the financial performance here is, frankly, not acceptable.”

Realigning U.S. Operations

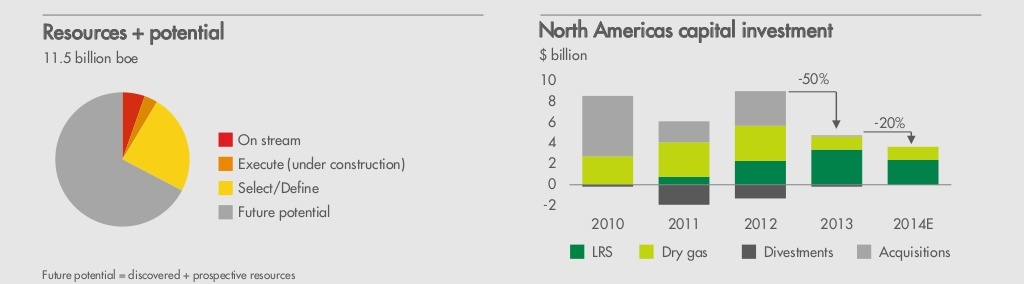

RDS.B’s renewed focus for America-based upstream operations will be to exploit the lowest cost gas acreage with the best integration potential, according to its Management Day press release. Offshore operations will continue to focus on deep-water and heavy oil projects. Overall, Shell aims to cut capital expenditures by 20% in 2014, even though it holds 11.5 billion BOE in resources and prospective volumes across all of its acreage in the Americas. Investment in the Americas alone is scheduled to decrease by 60% compared to 2012 levels.

Shell has shifted the bulk of its focus to the Permian for upcoming operations – a strategy followed by fellow supermajor Chevron (ticker: CVX) in its recent analyst day. Another giant, ExxonMobil (ticker: XOM) will be exploiting the nearby Woodford Shale. The Permian, in addition to the Duvernay formation in Canada, will be the main North American drivers for Shell in 2014. The company estimates more than 30 separate wells in the two plays hold flow rate potential greater than 1,000 BOEPD. Shell owns 95% equity on its 360,000 Duvernay net acres, with 1,100 potential drilling locations that have already been de-risked. A total of 67 wells were drilled in the Permian in 2013 and contributed to Shell’s overall production of 25 MBOEPD (70% liquids) from the region.

Shell is in the midst of selling its Eagle Ford, Mississippian Lime and liquid-heavy assets in the Rockies, citing mixed drilling results and acreage that is materially insufficient for a company of Shell’s size. In an interesting move, Shell purchased 1.22 MMBO, the second largest amount of any participating company, in the United States’ strategic oil reserve sale on March 17, 2014. The sale is the first since 1990.

LNG and Deepwater Operations in Future Plans

Despite the reported downtick in operations, the upstream Americas division produced 735 MBOEPD (40% gas) in 2013. The Gulf of Mexico currently accounts for roughly half of production in the United States. Gas, and more specifically LNG, is primed to be a key piece moving forward as Shell has invested in large gas plays in Canada, Alaska and around the Gulf Coast. Shell said it will not drill in Alaska this year but will pay close attention to development of the Keystone Pipeline. The company has prepared itself with considerable opportunities in Alaska if necessary in the form of 410 federal leases.

Deepwater operations will continue to commence in the Gulf, where Shell holds ownership to 450 federal leases. While the majority of deepwater plays are still in its infancy, the projects still produced 200 MBOEPD for Shell in 2013. Shell sees the majority of its LNG growth coming from international projects. Internationally, two LNG projects near Australia are forecasting growth of 30% in the stated department and are tentatively slated to begin in 2016. Shell will begin development of the Libra Field offshore Brazil (20% ownership), an area estimated to hold between 8 billion and 12 billion BOE, by 2017.

Successful Growth will Lead to Returns

Although the company is dialing back expenditures, many past purchases have been viewed as a long-term investment. Other opportunities are always available, but company executives emphasized the importance of not over-investing at too early of a stage. 2014’s capital budget will consist of $37 billion – a year over year reduction of 20%. The company is planning to divest as much as much as $15 billion in asset sales through 2015, and roughly $4 billion in sales have already been completed in 2014. Considering Shell sold $16 billion in assets from 2011 to 2013, its new goal is not unrealistic.

Shell’s refined focus through divestures and a reduced budget is designed to improve free cash flow and returns. Management also said capital returns are around the corner.

Simon Henry, Chief Financial Officer of Shell, said, “(An analyst once wrote) a report called “Walk or Chew Gum,” which essentially was a premise that no major company has ever done both returns and growth at the same time, but we can only do one or the other.”

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. A member of EnerCom has a long-only position in Shell.