Other parts of this series:

In my last blog, I talked about the LP&I industry’s serious image problem and why that’s fuelling a talent crisis. Written off as stale and uninspiring by most young people, LP&I companies urgently need to reinvent themselves. The goal? Become the kind of business that can attract and retain bright talent – in digital, as well as in other areas like sales, branding, marketing and legal.

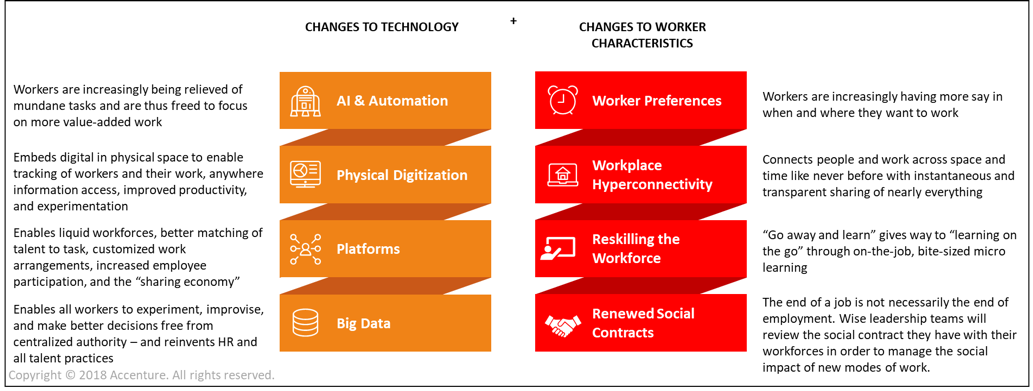

We’ve identified a handful of key cross-industry trends in both technology and worker characteristics that showcase why changes to the workforce are inevitable:

Clearly, LP&I companies need to act to meet the above trends and counter the severe PR problem. After all, these negative perceptions are deterring their future workforce (40% of firms are already reporting talent shortages). But there’s another level to all this: an injection of fresh, new talent will bring benefits that go far beyond just maintaining headcount.

As the marketplace becomes increasingly digitalised, it looks like the future of LP&I will lie elsewhere than in directly advised sales (or hiring IFAs). Assuming that’s the case, LP&I companies need to reposition themselves and pivot to a new, more relevant model.

In my next blog, I’ll examine what they can do to build tomorrow’s workforce today and enable growth and savings. But for now, let’s take a closer look at the reasons why LP&I companies need to adapt and modernise…and why they need to start now.

First, they need to deliver modern products. To cater to an increasingly tech-savvy customer base, they’ll have to modernise their offerings. Otherwise they’ll quickly lose relevance. And there’s no shortage of competitors looking to grab a slice of the market.

Look at the insurtech startups that are penetrating with increasing frequency. Free from any legacy constraints, they offer insight-driven solutions that allow them to access and build up a bank of customer data that ultimately results in a much better user experience.

As I said in my previous blog, the customers of the future have complex needs and expectations that differ wildly from their predecessors. To retain (or win) the business of these fickle buyers, who will happily jump ship if they feel their interests are better served elsewhere, firms need to understand their expectations. Only then will they be able to provide products that acknowledge their deviation from the traditional finance lifecycle model (may not get married, may have children later in life, etc).

Next, to develop the capabilities that enable this level of customer understanding at scale, firms need to ensure they’re attracting a wide variety of talent and skills. Specifically, this means more tech-savvy and future-thinking employees who can advise on the factors that influence product preferences – as well as bringing the digital know-how needed to develop these products.

That’s not all. Hiring people with skills in areas like analytics and data science will allow LP&I companies to obtain greater insight into their customers’ product preferences, attitudes to risk and more. This will lead to more accurate customer understanding (instead of only broad segmentation) and create the ability to tailor and target product offerings accordingly.

This skills gap urgently needs to be bridged. Right now, 33% of UK insurers claim a lack of resources with appropriate skillsets prevents them from adopting new technologies to facilitate more user-friendly customer service.

Additionally, as they look to the future, LP&I firms need to expand their definition of ‘talent’ to include automation and AI. As shown in the diagram above, these technologies are one element that is already transforming how work is done, and this is only the start: by 2030, 47% of jobs worldwide could be replaced by AI. This will transform the workforce, relieving employees of monotonous tasks and giving them the freedom to focus on more complex and rewarding assignments. Importantly, automation and AI should not be seen as replacing the workforce. Instead, it should co-exist, supplement and enhance what the workforce can achieve. Management should put dedicated effort into workforce optimization and re-skilling, through ‘on the go’ learning, to ensure maximum value is being obtained.

Modernising with new bright talent also means LP&I companies will benefit from a more flexible and future-looking workforce. That’s a must-have. With office rents rising inexorably, many companies have become more open to remote working and are investing in technologies that enable hyper-connectivity to ensure information is always available. This empowers employees to dictate their own schedules.

These organisations recognise the value that flows from accommodating worker preferences on when and where they work – in terms of lower costs (less staff turnover) and improved staff loyalty. And there’s no doubt that this trend is on the upswing: in recent surveys, 34% of business leaders said they expect more than half their workforce to be working remotely by 2020; 25% expect 75% of the UK workforce to be working remotely by then.

Modernising with new talent brings within reach all the benefits I’ve identified. In my next blog, I’ll look at the practical steps illustrated below (reimagining the work, workforce and enablers) that LP&I companies can take now to start creating the workforce of the future.

Meanwhile, I’m fascinated as ever to hear your thoughts, so please email me or leave a comment below. Thanks for reading.