A network effect is a phenomenon in which as more people or users join a platform, the more the value of the service offered by the platform improves for those joining afterward. Imagine the case of a platform like LinkedIn. For each additional user, joining, which also enriches the online resume, makes the platform more valuable to recruiters, as they can easily find qualified candidates. This is an example of a two-sided network effect.

| Definition Network Effects: The value of a service/platform inreases for each additional user, as more users join in. | Sub-type | Description – Example |

| Direct, Same Side or One-Sided | As more users join, the platform’s value increases for each additional user. Take the case of a social media platform, like Facebook, Instagram, TikTok, LinkedIn, Twitter. The more users join, the more the platform will be valuable for each additional user, as the new user might find exponentially richer and broader content (provided the platform can prevent congestion or pollution). | |

| Indirect or Cross-Side | In this case, a user type joining the platform makes it more valuable for other user types. Take the case of LinkedIn. While LinkedIn enjoys the same-side network effects, the platform becomes more valuable to users looking to enhance their careers as more users join in. At the same time, LinkedIn enjoys indirect or cross-side network effects. More users who join the platform to grow their career make it more valuable for recruiters (so a different user type) as they can find more qualified candidates on top of the platform. | |

| Two-Sided | Take the case of LinkedIn. While LinkedIn enjoys the same-side network effects, the platform becomes more valuable to users looking to enhance their careers as more users join in. At the same time, LinkedIn enjoys indirect or cross-side network effects. In this case, a user type joining the platform makes it more valuable for other user types. More users who join the platform to grow their career make it more valuable for recruiters (so a different user type) as they can find more qualified candidates on top of the platform. | |

| Multi-Sided | In this case, more than two user types are driven by the network dynamics. Take the case of Uber Eats; the more restaurants join the platform, the more the platform becomes valuable for eaters. While at the same time, by leveraging on its existing platform, Uber drivers have additional riding options. So they can earn extra income by delivering food instead of giving rides. That makes the overall platform much more valuable for the three main user types: eaters, restaurants, and riders. |

| Definition Negative Network Effects: The Value of the sercice/platform decreases for each additioanl user, as more users join in. This might be due to congestion (when increased usage can’t be handled by the platform) or pollution (when the increased size of the network makes it hard to incrementally add value, and instead its value shriks). | Description – Example |

| Congestion (Increased Usage) | In this case, there is a reduced quality of the service when certain parts of the networks carry way more data than they can handle. That usually happens because of scale limitations and noise due to curation limitations. Since this is a technological issue, it manifests as service slowdown or perhaps the platform crashing. Take the case of services like YouTube crashing for too much traffic. Or, if you’re a professional, a service like Slack crashes as it cannot handle the traffic spikes. That becomes a disservice with potential negative network effects because you suddenly prevent a whole team from functioning properly. Therefore, a negative network effect can have exponential negative consequences. For instance, users would switch to alternatives en masse if this was repeatedly happening, thus creating structural damage to the network. |

| Network Pollution (Increased Size) | The case of pollution is more tied to the ability of the platform to keep its service relevant at scale. Thus, imagine the case of a platform like Twitter, in which the principal asset is the feed. As Twitter becomes more and more popular, it needs to make sure that the user-generated content is qualitatively on target. Otherwise, the risk is for the user’s Twitter feed to become less relevant and lose value. Or imagine the case that many user-generated platforms face today, where spambots take over. Here, suppose the platform cannot handle this automatically generated content. In that case, it can quickly lose value, as the service becomes worthless for users (take the case of a user who has to spend an hour a day cleaning up the feed because of spamming). |

Platform business models and network effects

Network effects have become an essential element of a successful digital business, for several reasons. First, the Internet itself has become a facilitator for network effects.

As it becomes less and less expensive to connect users on platforms, those able to attract them in mass become extremely valuable over time.

Also, network effects facilitate scale. As digital businesses and platforms scale, they gain a competitive advantage, as they control more of the total shares of a market.

Last but not least, as we will see, network effects are considered among the defendable, or what confers to digital business, a competitive advantage.

Where in the past linear businesses gained a competitive advantage by buying assets and controlling supply chains. Digital companies gain competitive advantages by building network effects.

As we’ll see there are different kinds of network effects. And network effects can also be reverse or negative.

Competitive advantage = network effects

If you think about something like Instagram, the software is great but could fairly easily be replicated. But the network of users and the content they create is impossible to replicate. That is where the value is created. Or think about Reddit where the community creates the content. Or think about Waze where the users generate the data about which way has the least traffic.

In the era of platform business models in most cases, technology can bring an initial advantage. However, over time technology might become a commodity as it can be easily copied and replicated as it becomes wider adopted.

What can’t be easily copied is the community comprised of the network of users part of the platform. That is because users interacting produce several positive network effects.

Positive network effects

As more users join the platform the more it becomes valuable. Think of the case of a dating app with a few users in your town. How many chances there are the app would be able to match you up quickly? A few, thus the app won’t be much valuable to you

Data ownership

The interactions between users also generate data that the platforms can control, analyze, and own, which can be leveraged to create a lasting advantage. Therefore, the value of the network isn’t necessarily in the technology but in the data produced by the interactions

From transactions to interactions

As network effects become a primary advantage of the platform business, which can’t be easily replicated. The company needs to shift its mindset and manage the interactions in the platform. This is a key step to take. Think of the case of a company like Amazon, which over the years passed from being e-commerce to a platform business.

Indeed, most of. the transactions that happen today on Amazon are mostly from third-party sellers. While Amazon understood the value of network effects and of flywheel models early on.

A platform business model implies that the company in charge of the ecosystem that generates those network effects learns how to keep those interactions happening. This implies a shift in mindset to think in terms of product sales to interactions happening on the platform.

To understand this concept read the full interview on digital platform businesses.

The power of network effects

Image credit: Ray Stern, CMO of Intuit.

Network Effects enable digital businesses to gain value quickly. That is because they have built-in asymmetries between the costs and value of the network. Where costs might increase linearly, the value of the network increases exponentially as the network grows.

Network effects have become a key ingredient in the digital era enabling the dominance of a particular business model: the platform business models.

The era of platform business models

Platform business models make up most of the value captured and created by digital businesses.

Companies like Google, Facebook, LinkedIn, PayPal, and more are platform business models, which benefited and created a strong competitive advantage by leveraging network effects.

Image Credit: Applico, Inc.

That’s because, in theory, platform business models manage to scale efficiently. Thus, where a traditional business, at a particular scale, it reaches a point of inefficiency where diseconomies of scale pick up.

A digital, platform business, might scale so efficiently, to be able to grow close to the total size of the market. This enables the formation of monopolies.

Thus, network effects become the real “assets” in the digital era. However, those “assets” won’t be seen on the company’s balance sheets.

Quite the opposite, platform business models enable exchanges among a large number of people within a network, but in most cases, they don’t control any of the assets owned by the people in the network.

Instead, those platform businesses only facilitate exchanges. And as a facilitator, they collect a “tax” as a transaction fee. That’s why modern platform business models might look and act more like nations, rather than corporations.

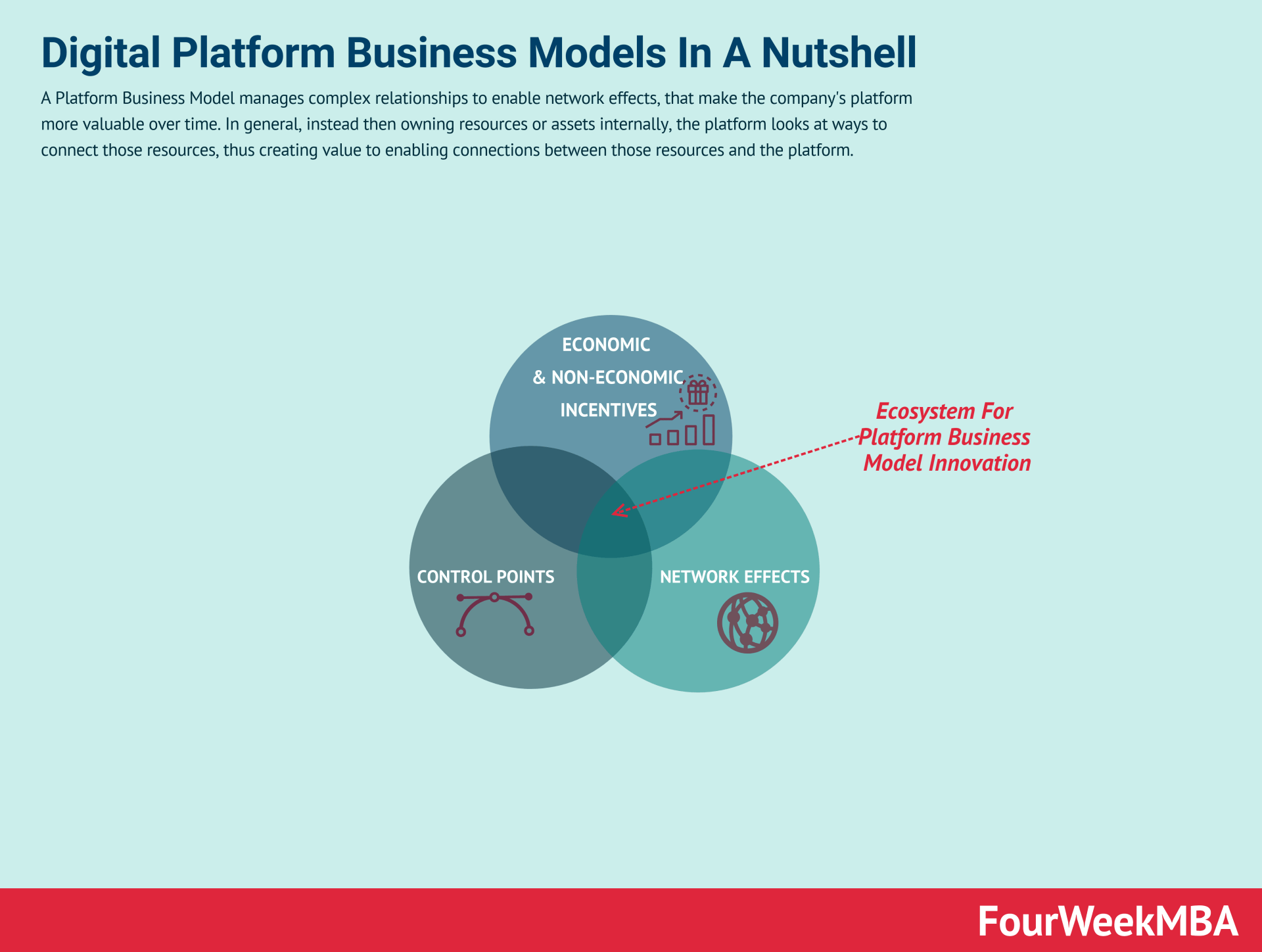

Read: Platform Business Models In A Nutshell

Types of network effects

Examples of network effects

Source and Image Credit: nfx.com

NFX points out thirteen main types of network effects:

- Physical (e.g., landline telephones)

- Protocol (e.g., Ethernet)

- Personal Utility (e.g., iMessage, WhatsApp)

- Personal (e.g., Facebook)

- Market Network (e.g., HoneyBook, AngelList)

- Marketplace (e.g., eBay, Craigslist)

- Platform (e.g., Windows, iOS, Android)

- Asymptotic Marketplace (e.g., Uber, Lyft)

- Data (e.g., Waze, Yelp!)

- Tech Performance (e.g., BitTorrent, Skype)

- Language (e.g., Google, Xerox)

- Belief (currencies, religions)

- Bandwagon (e.g., Slack, Apple)

As James Currier, from NFX, points out, “Network effects have emerged as the native defense in the digital world.” Within network effects as a defensible NFX points out three key elements: scale, brand, and embedding.

It is essential to highlight that the types of networks above are not exhaustive, neither set in the stone. But the framework offered by NFX is a great starting point to understand how network effects work.

In this guide, I want to focus on two main kinds of network effects:

- Direct or same-side.

- And indirect or cross-side.

Direct or same-side network effects

Direct or same-side network effects happen when an increasing number of users or customers also increases the value of the product or service for the same kind of user.

Direct network effects usually follow Metcalfe’s law (one of the laws on the basis of network effects).

In short, Metcalfe’s law, developed in communications theory, states that, as users of a network grow, this enables the exponential growth in the number of potential connections, thus also an exponential increase in utility of the platform.

Indirect or cross-side network effects

Indirect or cross-side network effects happen when an increased number of users on the side of the platform drives up the value of the product or service offered for the other side of the platform.

Indirect network effects aren’t necessarily symmetric. In other words, in some cases, increasing one side of a platform might have more profound effects, than increasing the other side.

For instance, in Uber’s case, as a two-sided platform, driven by the exchanges between drivers and riders, the former plays a more critical role.

Indeed, Uber uses dynamic pricing strategies that make the service less convenient for riders, but it keeps drivers going back to the platform.

Also, indirect network effects might not necessarily be reciprocal. Thus, increasing the one side of the network might improve the service for the other side. But the same might not apply if the other side of the network is increased.

Virality vs. network effects

Source: platformed.info

I want to clarify the critical difference between virality and network effects. Often (too often) those terms are used, or thought of as the same thing.

However, they are not, and understanding the critical difference between the two is vital to also formulate a better business strategy for a platform business model.

Network effects happen when a platform becomes more valuable as more users join it. Virality instead is a growth tool that companies can use to create more exposure for their product or platform.

Thus, a network effect is a way to create a lasting competitive advantage. And to offer more value to users. A viral effect is primarily a marketing tactic to gain traction and visibility for your product.

Network effects and virality can work together. For instance, as more users join through viral effects, if the platform is taking advantage of network effects, the more also it will become prone to improve its virality.

As highlighted in the interview with Sangeet Paul Choudary, best selling author of Platform Scale and Platform Revolution:

Network effects create value on the platform. Viral effects spread the word about the platform or the product externally.

And he continued:

So network effects, an example is the more users who are on Airbnb. The more hosts are setting up listings on Airbnb, the more choice there is for travelers. Now that’s a network effect.

Or take the example of YouTube, the more videos that are being set up on YouTube, the more choice I have as a viewer to view things on YouTube.

Instead, virality happens when:

Now, if I take a video from YouTube and embed it on Facebook, that’s not a network effect, that’s a viral effect.

In short:

So a viral effect is a growth tool that brings external users back to the platform. Whereas a network effect increases the value on the platform, just like adding more than more and more videos onto YouTube.

Beware of negative network effects

Network congestion

As highlighted in the interview with Sangeet Paul Choudary, author of Platform Scale and Platform Revolution:

The more people using the highway system, the more traffic jams you end up in. Or the more people in a room, the less likely it is to have good decent conversation just because it gets crowded, but also because everybody is talking too loudly and so you can’t hear and you can’t meet the right person within that room.

He continues:

So we understand congestion in traditional terms because in the traditional world we have networks that were limited by scale.

When it comes to the digital world, instead, where there are fewer scale limitations. Or at least those can be initially overcome.

Thus, at least on the congestion side, it’s very hard to reach a point of negative network effects (for instance, if the platform crashes for usage).

Congestion, therefore, is primarily about the usage of the network.

In the bits world, it is possible not only to overcome congestion but also to build a more solid engineering infrastructure as usage increases. Of course, network congestions can also be bad for platforms (poor network design, over-subscription, security attach due to overused network parts).

Another form, of negative network effect, can take place for platform business models.

Network pollution

Where network congestion is primarily about the size of the platform.

As the platform scales, it gains network effects, as it becomes more valuable for an increasing number of users.

Yet, also for digital platforms scale might create situations of diseconomies.

As highlighted in the interview with Sangeet Paul Choudary:

What happens is the more users come on board, the more difficult it becomes to manage quality of the interactions.

Thus this makes the digital platform make sure to have a mechanism to manage the quality of those interactions to avoid that those negative network effects pick up.

If we think of social media, or publishing platforms at scale, among the most difficult task, that requires dozens if not hundreds of engineers and humans (Google might have thousands of human quality raters) to fix spam and low-quality user-generated content.

Examples of negative network effects

As highlighted negative network effects, dilute the value of the platform. And the way they can take over will depend on the kind of platform you’ve built. For instance:

Google case study

In a platform that leverages direct side network effects after a certain number of users, it might also result in increased spam on the platform which can’t be easily managed through automated processes, or human curation, thus diluting the value of the platform.

Take the case of how Google, back in the days, it was offering an index of the web with its core algorithm called PageRank. At a certain point had to figure out also how to manage the spam on its index.

Practitioners understood how to trick Google’s core algorithm into showing up spammy results on top of that. This would have jeopardized the value of the overall platform, thus resulting in a diluted value of that.

Thus Google had to start to build up a solid team dedicated to spam and update its algorithms to avoid spam in search results in order to keep its platform valuable.

Airbnb case study

In two-sided platforms, a kind of user joining the platform makes it more valuable for another type of user.

Take Airbnb where, for instance, more hosts improve value for users on the platform. On the two-sided more value is created by more hosts (travelers have more selection)? On the other hand, the value of the platform is diluted on the hosts’ side of the platform.

They will find themselves competing for the same users.

Thus it becomes crucial to understand what’s the proper ratio between travelers and hosts on the platform to make sure it keeps being valuable on both sides.

Tinder case study

Take the case of a dating app that draws value from having people encounter locally. If more users join but from locations spread across the world, no many local network effects are picking up.

Quite the opposite. If a critical mass is not reached at each local hub, the platform might lose value quickly. Imagine the case of a woman looking for a date. The faster she will be able to meet the best match.

The more the platform will be valuable. However, to be very valuable, the service has to make sure those people can meet in a place nearby. And it there are no matches available locally, the dating platform would lose value quickly.

Amazon from e-commerce to platform

When Amazon first started, its business model was an e-commerce.

Over the years, especially in the early 2000s, Amazon started to explore the option to feature more and more third-party stores, on top of Amazon.

By 2014, for the first time in its history, third-party sales passed the sales of Amazon own products. While the process of transitioning from e-commerce (simply selling its own products) to platform (enabling others to sell their own products), started in the early 2000s, it took over ten years for Amazon to complete this transition.

And this was all about network effects!

Today, Amazon is a platform business model, with built-in network effects.

Why is it about network effects?

Because, by the early 2000s, Amazon business model engine had to be structured in terms of network effects within its platform strategy.

Indeed, the more third-party sellers joined the platform, the more the platform became valuable to users, who could find more product variety.

And, Amazon could further pass lower prices to its customers. Once this process was repeated over and over, this is how Amazon built positive feedback loops into its business model.

And this was a paradigm shift!

Netflix, from platform to media company

While some companies transition to a platform strategy, and therefore, need to start thinking in terms of network effects.

Other companies go into the opposite direction.

Take the case of Netflix business model:

Netflix started primarily with a platform strategy, offering licensed content on top of its platform.

It first transitioned from CD rental, to DVD subscription services. Then it moved to on-demand streaming, with an effective subscription model, with no surplus charges, neither late fees.

Yet, starting in 2013, Netflix started to invest more and more on producing its own content!

By 2021, content produced by Netflix represented 34% of the total investments made in content. This is a huge jump, considering that in 2019 alone, that number was 21%.

This, I like to call, the “mediafication of Netflix” where Netflix is completing its transition from platform (where it solely focuses on building the underlying infrustructure to enable others to offer their content) to media powerhouse (think of it as the new Hollywood!).

The on-demand streaming platform is still driven by network effects, but those are trickier. Indeed, those are more cultural network effects.

Imagine the case of more and more people watching Netflix original series, those who don’t will feel left out, and they will feel compelled to join in!

Key take on negative network effects

Platform business models can leverage network effects to enable the core platform to become more valuable over time. However, they need to factor in negative network effects, which if picking up might not only prevent the success of the business but also destroy it.

Key takeaways on network effects

- The internet has become a facilitator for network effects.

- Digital businesses work on a set of premises and principles that are different from traditional or linear businesses.

- Network effects have become the “assets” for digital organizations.

- Those network effects don’t sit on companies’ balance sheets. Rather digital businesses can trigger and build them up to create a strong competitive advantage.

- Network effects enable digital businesses to scale efficiently and to get close to the total size of the market.

- Network effects can be direct (when they when an increased size of the network improves the value of the platform for the same kind of users) and indirect (where the increased size of one side of the network improves the service for the other side).

- Network effects are not the same thing as virality. Virality is a marketing tactic to acquire users or customers at a lower cost. Network effects represent a business strategy aimed at creating a long-term competitive advantage for digital businesses.

Understanding what a platform strategy entails

When it comes to platform business models it’s important to think in terms of markets and ecosystems. In short, as the platform usually makes money as fee-based on the interactions among key players on the platform, its main role will be the development of the market it sits on.

For instance, if we look at how various tech players evolved over the years based on a platform strategy, we can see how those first developed an ecosystem, and then “extracted” fees in the form of a tax from the key players once the new ecosystem had been built. Perhaps in the PC era, Microsoft’s Windows followed a platform strategy, where the PC worked as the hardware for Microsoft’s software products. On top of these, Microsoft built products, it helped other developers build their own products and it fostered an ecosystem to control the whole distribution.

As we moved from PC to smartphone other players like Apple use the same platform strategy. Perhaps, what made the iPhone interesting in the first place were the apps available in it. The App Store, therefore, evolved as a platform, that Apple fostered over the years, and that in 2020 made Apple $64 billion in revenues, as reported by CNBC.

This is what a platform strategy entails. That is why platform business models are evaluated in terms of the market they can capture.

The wider the total addressable market, the more it will be interesting also for potential investors to finance the development of that ecosystem, as the platform will be able over time to extract value in form of revenues from that (here we’re not discussing whether that’s fair or not, but just how digital platforms evolved in the web era).

It’s worth noticing that platforms usually grow a business ecosystem by killing the fragmented intermediaries existing in a market (think of what Uber initially did with Taxis, and what Airbnb initially did with Hotels). While these players do eat up part of an existing marketplace, the main argument is also that those do expand the existing ecosystem, as they scale it up, thus bringing more potential customers into a system that before was clogged by too many intermediaries.

As a quick example, many Uber users might use it in ways that never had been done with Taxis (perhaps with users going so far as to sell their cars to only moving locally through Uber’s app).

That is also why marketing for a platform business model looks more like a flywheel, where there is a continuous loop between key players that feed each other’s thus making the flywheel spin faster. The classic example is the Amazon flywheel.

Other examples are below:

Key Highlights

- Network Effects Definition: Network effects refer to the phenomenon where the value of a service or platform increases as more users join, making it more beneficial for both existing and new users.

- Types of Network Effects:

- Direct or Same-Side Network Effects: More users on the same side of the platform (e.g., users of a social media platform) increase the value for each user.

- Indirect or Cross-Side Network Effects: More users on one side of the platform (e.g., job seekers on LinkedIn) increase the value for users on the other side (e.g., recruiters).

- Negative Network Effects:

- Congestion (Increased Usage): Reduced quality or performance of the service due to increased usage, potentially leading to service slowdown or crashes.

- Network Pollution (Increased Size): Diminished value as the platform grows larger, affecting the quality of interactions, content, or services.

- Network Effects in Platform Business Models:

- Network effects are a core element of platform business models.

- They contribute to a platform’s competitive advantage, as they can’t be easily replicated.

- The community of users and the data they generate through interactions become valuable assets.

- Positive vs. Viral Effects:

- Positive network effects improve the platform’s value for users.

- Viral effects are marketing tactics that create exposure and visibility for the platform.

- Examples of Network Effects in Businesses:

- Importance of Managing Negative Network Effects:

- Businesses need to address potential negative network effects such as congestion or network pollution.

- Solutions include quality control, spam prevention, and managing the balance of user types.

- Digital Era and Network Effects:

- The internet facilitates network effects by connecting users at lower costs.

- Network effects enable digital businesses to scale efficiently and gain a competitive advantage.

- They have become the primary “assets” for digital organizations.

- Key Takeaway:

- Network effects play a critical role in shaping the success of platform business models.

- They offer a sustainable competitive advantage by making the platform more valuable as it grows.

- Proper management of negative network effects is essential to maintain the platform’s value and user satisfaction.

Case Studies

| Company | Network Value | Network Effects |

|---|---|---|

| More users make the platform more valuable for social interaction. | Direct (Same-Side) Network Effects | |

| An increase in professionals on the platform benefits job seekers, recruiters, and businesses. | Direct (Same-Side) and Indirect (Cross-Side) Network Effects | |

| Uber | More riders attract more drivers, reducing wait times and improving the service. | Direct (Same-Side) and Indirect (Cross-Side) Network Effects |

| eBay | A larger number of buyers and sellers result in a broader selection of products. | Direct (Same-Side) Network Effects |

| Amazon | Third-party sellers add to the product catalog, attracting more buyers. | Indirect (Cross-Side) Network Effects |

| More users improve the quality of search results, attracting more advertisers. | Direct (Same-Side) and Indirect (Cross-Side) Network Effects | |

| Apple App Store | A growing developer community leads to a richer app ecosystem, benefiting users. | Direct (Same-Side) Network Effects |

| Airbnb | More hosts attract more travelers, creating a robust marketplace for rentals. | Direct (Same-Side) and Indirect (Cross-Side) Network Effects |

| Snapchat | As more friends join, the platform becomes a more appealing way to communicate. | Direct (Same-Side) Network Effects |

| The app’s value increases as more contacts within a user’s network adopt it. | Direct (Same-Side) Network Effects | |

| Waze | User-contributed data about traffic and road conditions enhances the app’s accuracy. | Direct (Same-Side) Network Effects |

| Slack | The platform becomes more effective for collaboration as more organizations adopt it. | Direct (Same-Side) Network Effects |

| A larger user base results in more diverse and real-time content, attracting more users. | Direct (Same-Side) Network Effects | |

| Netflix | A wider selection of content and recommendations improve the platform for subscribers. | Direct (Same-Side) Network Effects |

| Spotify | More users lead to better playlists and music recommendations, enhancing the user experience. | Direct (Same-Side) Network Effects |

| Yelp | Increased user reviews provide more information and choices for consumers and businesses. | Direct (Same-Side) Network Effects |

| Google Maps | User-generated location data improves map accuracy and navigation for all users. | Direct (Same-Side) Network Effects |

| More users contribute to a richer feed of visual content, making the platform more engaging. | Direct (Same-Side) Network Effects | |

| A growing user base results in a more extensive collection of pins and ideas for users. | Direct (Same-Side) Network Effects | |

| TikTok | As more creators join, the platform offers a wider variety of short-form videos to viewers. | Direct (Same-Side) Network Effects |

| Related Concepts | Description | When to Apply |

|---|---|---|

| Network Effects | Network effects refer to the phenomenon where the value of a product or service increases as more people use it. It can result in positive feedback loops, where increased adoption attracts more users, leading to further growth and enhanced utility for all participants in the network. Network effects are often observed in platforms, social networks, and marketplaces. | – When designing and launching platform-based products or services that benefit from user interaction and network effects – When analyzing market dynamics and competitive positioning to leverage network effects as a strategic advantage – When developing growth strategies to accelerate user adoption and expand network reach – When evaluating investment opportunities in companies or industries driven by network effects for potential long-term growth and profitability |

| Platform Economy | Network effects are central to the platform economy, where digital platforms facilitate interactions and transactions between users, producers, and consumers. Platforms leverage network effects to create value by connecting participants, fostering collaboration, and enabling the exchange of goods, services, or information. | – When building or investing in platform businesses that rely on network effects to attract users and build ecosystem momentum – When developing platform strategies to enhance user engagement, retention, and satisfaction – When studying platform business models and ecosystem dynamics to identify opportunities for value creation and competitive differentiation – When assessing regulatory and market risks associated with platform-based business models and network effects |

| Metcalfe’s Law | Metcalfe’s Law states that the value of a network is proportional to the square of the number of connected users or devices. It underscores the exponential growth in network value as the size of the network increases. Metcalfe’s Law is commonly used to quantify the impact of network effects and assess the value of networked systems and technologies. | – When evaluating the potential impact of network effects on the valuation and growth prospects of network-based businesses – When modeling the value of networks and estimating their economic or social utility – When designing and optimizing network architectures to maximize connectivity and interaction among users – When analyzing network growth patterns and adoption dynamics to predict future performance and scalability |

| Two-Sided Markets | Two-sided markets are platforms that facilitate transactions between two distinct user groups, such as buyers and sellers, advertisers and consumers, or drivers and passengers. Network effects play a critical role in two-sided markets by creating value for both sides of the platform, often leading to multi-sided network effects where growth in one user group enhances the value proposition for the other. | – When developing business strategies for two-sided platforms that balance the needs and incentives of multiple user segments – When designing pricing, incentive, and subsidy mechanisms to attract and retain users on both sides of the platform – When studying the dynamics of two-sided markets to understand how network effects influence platform growth and sustainability – When assessing regulatory implications and competitive dynamics in two-sided markets to mitigate risks and leverage opportunities |

| Virality and Growth | Network effects drive virality and growth in products or services by enabling rapid dissemination and adoption through social sharing, referrals, and word-of-mouth recommendations. Viral growth occurs when satisfied users promote the product or service to their networks, resulting in exponential user acquisition and network expansion. | – When designing products or features with built-in virality to encourage user sharing and referrals – When implementing growth hacking strategies to amplify word-of-mouth marketing and user acquisition – When measuring and optimizing viral coefficients and referral metrics to drive sustainable growth and engagement – When leveraging social media and influencer marketing to amplify the reach and impact of viral campaigns |

| Lock-In and Switching Costs | Network effects can create lock-in effects by making it costly or inconvenient for users to switch to alternative products or platforms. Switching costs, such as data migration, retraining, or loss of network benefits, reinforce user loyalty and retention, leading to higher barriers to entry and increased competitive advantage for incumbent players. | – When designing product features or services that enhance user stickiness and reduce churn through network effects – When implementing loyalty programs, rewards, or incentives to reinforce user engagement and retention – When analyzing customer lifetime value and churn rates to assess the effectiveness of lock-in strategies and switching barriers – When monitoring competitive threats and market dynamics to adapt lock-in strategies and retain market leadership |

| Ecosystem Development | Network effects drive ecosystem development by attracting complementary products, services, or applications that enhance the value proposition and functionality of the core platform or network. Ecosystem partners contribute to network growth, innovation, and differentiation by integrating with the platform, developing compatible offerings, or extending the platform’s reach to new markets or use cases. | – When building and managing platform ecosystems that leverage network effects to attract developers, partners, and third-party providers – When fostering collaboration and co-creation with ecosystem partners to expand platform capabilities and user value – When developing open APIs, SDKs, or developer tools to facilitate integration and interoperability within the ecosystem – When measuring ecosystem health, growth, and vibrancy to assess the impact of network effects on platform sustainability and competitive positioning |

| Data Network Effects | Data network effects arise from the accumulation and analysis of data generated by user interactions within a networked platform or ecosystem. As more data is collected and analyzed, the platform can offer more personalized experiences, predictive insights, and targeted recommendations, driving user engagement, satisfaction, and loyalty. | – When implementing data-driven strategies to harness the value of user-generated data and behavior insights – When developing algorithms and machine learning models to leverage data network effects for personalization and recommendation – When addressing privacy and data governance issues to ensure responsible data use and compliance with regulatory requirements – When measuring the impact of data network effects on user satisfaction, retention, and lifetime value to optimize data-driven strategies and investments |

| Scale Economies | Network effects lead to scale economies by spreading fixed costs over a larger user base and increasing operational efficiency and productivity. As the network grows, unit costs decline, allowing platforms to offer competitive pricing, invest in innovation, and capture a larger share of the market. Scale economies reinforce network effects by attracting more users and driving further growth. | – When analyzing cost structures and economies of scale in platform-based businesses driven by network effects – When developing pricing strategies that leverage scale economies to offer competitive pricing and capture market share – When investing in infrastructure, technology, and automation to support scalable growth and improve operational efficiency – When forecasting cost reductions and margin improvements resulting from network expansion and increased user adoption |

| Market Dominance | Network effects can lead to market dominance and monopolistic tendencies in industries where a single platform or network emerges as the dominant player, controlling significant market share and setting industry standards. Network effects reinforce barriers to entry, deter competition, and consolidate market power, raising concerns about anti-competitive behavior and regulatory oversight. | – When assessing market concentration, competition dynamics, and regulatory risks in network-based industries – When evaluating merger and acquisition opportunities to consolidate market power and expand network reach – When monitoring antitrust investigations and legal challenges related to market dominance and anti-competitive practices – When advocating for fair competition and open standards to promote innovation, consumer choice, and market efficiency in network-driven markets |

| Localized Network Effects | Localized network effects occur when the value of a network increases within specific geographic regions or communities due to local network effects. These effects can result from network density, social connections, or shared interests within local communities, leading to network effects that are more pronounced at the local level compared to global or generalized networks. | – When targeting specific geographic markets or communities for localized network effects-driven growth strategies – When designing features or services that cater to the unique needs and preferences of local user groups or demographics – When fostering community engagement and grassroots initiatives to stimulate local network effects and user participation – When measuring and analyzing geographic user distribution and engagement patterns to optimize localization strategies and resource allocation |

Read next:

- Platform Business Models In A Nutshell

- Linear Vs. Platform Business Models In A Nutshell

- What Are Diseconomies Of Scale And Why They Matter

Other business resources:

- Successful Types of Business Models You Need to Know

- The Complete Guide To Business Development

- Business Strategy: Definition, Examples, And Case Studies

- What Is a Business Model Canvas? Business Model Canvas Explained

- Blitzscaling Business Model Innovation Canvas In A Nutshell

- What Is a Value Proposition? Value Proposition Canvas Explained

- What Is a Lean Startup Canvas? Lean Startup Canvas Explained

- What Is Market Segmentation? the Ultimate Guide to Market Segmentation

- Marketing Strategy: Definition, Types, And Examples

- Marketing vs. Sales: How to Use Sales Processes to Grow Your Business

- How To Write A Mission Statement

Business models case studies:

- How Amazon Makes Money: Amazon Business Model in a Nutshell

- How Does WhatsApp Make Money? WhatsApp Business Model Explained

- How Does Google Make Money? It’s Not Just Advertising!

- The Google of China: Baidu Business Model In A Nutshell

- How Does Twitter Make Money? Twitter Business Model In A Nutshell

- How Does DuckDuckGo Make Money? DuckDuckGo Business Model Explained

- How Does Pinterest Work And Make Money? Pinterest Business Model In A Nutshell

- Fastly Enterprise Edge Computing Business Model In A Nutshell

- How Does Slack Make Money? Slack Business Model In A Nutshell

- Fastly Enterprise Edge Computing Business Model In A Nutshell

- TripAdvisor Business Model In A Nutshell

- How Does Fiverr Work And Make Money? Fiverr Business Model In A Nutshell

Connected Economic Concepts

Positive and Normative Economics

Main Free Guides: