2022 is the year of shipping. Product tankers and LNG tankers are flying up on RuSSian war on Ukraine. Container ships are flying on supply chain congestion. We wrote several times here this year about Product tankers and LNG (we are long COOL, HAF, STNG, GLNG, FRO, MNTR). These trades have been very profitable. We like the Mintra idea, that was brought by Pareto Securities. It is a high beta trade on growth in Shipping and Energy. While most Shipping and Energy stock may not double from current levels this year, Mintra is a good doubling candidate for this year.

- Mintra (www.mintra.com) provides online training courses mainly for shipping and energy.

- Mintra was listed last year in Norway at 9.70 NOK at the end of 2020. Ticker MNTR

- Mintra was hammered in the pandemic – the crew teams (on shipping boats and energy platforms) did not rotate due to Covid.

- Lower crew rotations resulted in lower use of e-learning courses.

- The situation turned around now – shipping and energy companies are in the best shape for years, generating best profits in decades. They spent more money on hiring and crew rotations – Mintra should be the beneficiary of the shipping and energy turnaround.

- in 2021 Mintra acquired and successfully integrated SafeBridge.

- SafeBridge was losing cash, it is now profitable under Mintra wings.

- Mintra already has a 50% market share in the segment.

- Safebridge acquisition decreased competition and increased Mintra pricing power

- Mintra will grow by the increasing use of its courses by its existing customers, new contracts and acquisitions

- Mintra guided last year 10% revenue growth for 2022. Pareto analyst believes it is too conservative. It does not reflect the current boom in Mintra´s target sectors. The consensus is low.

- 1Q22 was Mintra´s best quarter ever – Mintra generated a 10% FCF yield in the quarter. That is 40% annualized FCF! They can generate CF equal to their market capitalization in 2.5 years.

- Next quarter is most likely much better than Q1.

- Pareto analyst has Mintra as a top pick in his area.

- SpareBank weekly research shows Mintra as one of the cheapest stocks in the sector.

- Mintra share price is up 70% from its March lows of 2.5 NOK to current 4.3 NOK. Still well below the 9.70 NOK listing price tag.

- Mintra is our doubling candidate from these price levels. It is a very good proxy to play shipping and energy boom. While most shipping and energy will not double from these levels, Mintra easily could.

Pareto on Product tankers this morning

HAFNI NO – HAFNI – Product tanker rates are moving higher again, particularly MRs and LR1s (key for Hafnia). Scorpio outperformed vastly yesterday, confirming that near all of Q2 are booked at rates that imply EPS of USD 3.5. BUY HAFNI; Q2 and Q3 estiamtes are still lagging sharply, and rate momentum seems to be returning. NAV towards NOK 50 by Q4.

Ranking of our writings

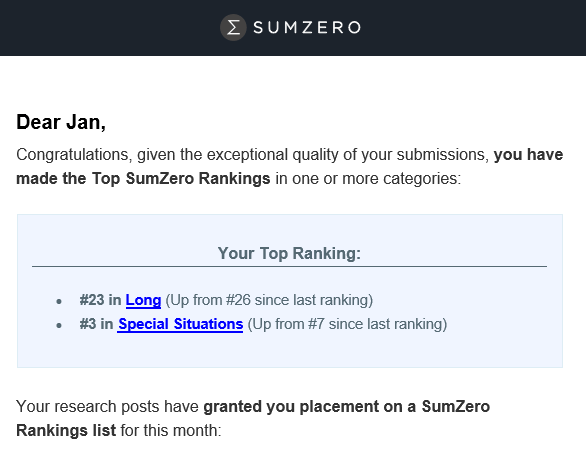

I publish our family office ideas on SeekingAlpha (largest retail investment ideas platform) and SumZero (largest hedge fund and professional investor investment idea platform). We have noticed two achievements this week.

- SumZero rated the performance of our ideas among TOP 25 and I was number 3 in the Special Situations sector.

- I saw that SeekingAlpha is using our ideas (for example on Linkfire) as paid add for getting investors on the platform.

Var Energy opportunity

Last night Var Energy did USD600m secondary placement of shares. Two shareholders were selling. The share price is down today by around 10% at time of writing as some investors sold the share. I believe the share price should recover. We bought in the SPO and bought in the market after open. Var is one of the best energy companies listed in NOrway. Good enetry point for both short term and longer term trading.

Disclosure:

The goal of the blog is to provide investment ideas for further research. I/we have a beneficial position in the shares discussed above either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. The article does not represent investment advice. Please do your own research before making any investment action.