Latest News

Better Collective reports organic revenue growth of 19% in Q1

Interim report January 1 – March 31, 2021

Highlights first quarter 2021

- Q1 revenue grew by 86% to 38,836 tEUR (Q1 2020: 20,921 tEUR). Organic revenue growth was 19%. The revenue split was 61% from Publishing and 39% from Paid Media.

- Q1 EBITDA before special items increased 46% to 13,193 tEUR (Q1 2020: 9,045 tEUR). The EBITDA-margin before special items was 34%. EBITDA-margin was 51% in Publishing and 7% in Paid Media. The margin in the Paid Media segment was significantly impacted by the switch from pure CPA to hybrid revenue models at a cost of approx. 2 mEUR. Excluding these impacts, the margin would have been 19%.

- Cash Flow from operations before special items was 16,102 tEUR (Q1 2020: 9,451 tEUR), an increase of 70%. The cash conversion was 121% due to an improvement of debtors and other short debt. End of Q1, capital reserves stood at 50.1 mEUR including cash of 34.8 mEUR and unused bank credit facilities of 15.1 mEUR.

- New Depositing Customers (NDCs) was around 180.000 in the quarter (increase of 54%) and is at an all time high.

- Better Collective has increased its ownership to 90% of the shares in Mindway AI that specialises in software solutions based on artificial intelligence and neuroscience for identifying, preventing and intervening in at-risk and problem gambling.

- Better Collective has strengthened its position in the Swedish sports betting market by acquiring online sports betting media platform, Rekatochklart.com for 3.8 mEUR.

Significant events after the closure of the period

- April revenue reached a record 13.1 mEUR, a growth of 185% vs. 2020, of which 51% was organic growth. Organic growth in the Publishing segment was 87% against a weak comparison due to the significant effect on April 2020 by the halt in sports during the COVID lockdown. In the Paid Media segment, organic growth was 14% against a strong comparison, as the halt in sports meant an increase in casino (predominant in the acquired Atemi Group)

- On May 3, 2021, Better Collective signed an agreement to acquire 100% of the shares in The Action Network, Inc. for 240 mUSD (198 mEUR) on a cash and debt free basis. With the acquisition of Action Network, Better Collective gains clear market leadership within sports betting media in the US and now expects to increase its revenues in the US to more than 100 mUSD by 2022.

- In April, a payment of 1.2 mEUR in cash, and 0.9 mEUR in shares were made to complete the 2020 earn-out payment relating to the acquisition of HLTV.

- Following the AGM on April 26, 2021, Therese Hillman was elected to the Board of Directors. Therese is a Swedish national born in 1980. She is the current CEO of NOD, and was until recently Group CEO of NetEnt, a premium game supplier to online casino operators and listed on Nasdaq Stockholm.

Financial targets 2021

The Board of Directors have decided on targets for the financial year 2021 as announced in the full year report. Following the acquisition of The Action Network and contingent on the closing of the transaction in Q2, 2021, the financial targets for 2021 are updated: Total group revenue is now expected to exceed 180 mEUR (previously more than 160 mEUR). Operational profit is now expected to exceed 55 mEUR (previously more than 50 mEUR). Total group organic growth is now expected to exceed 25% (previously more than 20%). See page 10 of the report for more detail.

Jesper Søgaard, Co-founder & CEO of Better Collective, commented: “Q1 was another strong quarter for us with significant revenue growth and an increase in the number of New Depositing Customers of more than 50%. We have continued to strengthen our global market position with the addition of Swedish sports betting media platform, Rekatochklart, and most recently, US sports betting media market leader, Action Network, while also increasing our ownership of Mindway AI to 90% to further expand our initiatives within responsible gambling. We are very pleased with these accomplishments.“

Powered by WPeMatico

Latest News

Unveiling Social Casino Trends: Insights into Player Behaviour

Who plays social casino games, and when and how do they engage? SOFTSWISS, a global tech company with over 15 years of expertise in iGaming, has analysed the data of about 700,000 SpinArena.net users to present major social casino gaming patterns and trends.

SOFTSWISS recently announced the acquisition of a stake in Ously Games GmbH, the German provider of the fastest-growing European social casino, SpinArena.net. SOFTSWISS experts explored the data provided by its partner to uncover major trends in social casino gaming and its differences compared to traditional online casinos.

Who is a Social Casino Player?

When discussing the social casino player profile, it is essential to highlight that over 80% of users conceal their age and gender. Among those who reveal this information are young men under 30.

Naturally, the majority of SpinaArena players are from Germany. The United Kingdom of Great Britain and Northern Ireland takes second place in the ranking, followed by players from other European countries, such as the Netherlands, Latvia, Italy, Greece and Poland.

For the sake of analysis, it is essential to consider that downloading applications for social casino games does not require age verification or the mandatory disclosure of a player’s gender or country of residence. Therefore, the analysis assumes that the data provided by players who chose to share their information is accurate.

When Do People Play in Social Casinos?

According to SpinArena.net data, the average player session lasts about 47 minutes. The longest player session recorded in 2024 exceeded 12 hours.

Players are most active during the day and in the evenings. The largest number of players is registered from 4 p.m. to 9 p.m., while the fewest – from 2 a.m. to 5 a.m. The activity is almost three times higher in the evenings than at night, and it is worth highlighting that judgement.

During the week, players are usually more active on Fridays and Sundays, while less activity is observed on Mondays. At the same time, the difference between the most and the least active days of the week is only around 10%.

Regarding the retention rate, SpinArena.net can boast intriguing figures. Data from German users shows that almost 40% of players are active on the first day after installing the application, while by the thirtieth day, this figure equals 14%.

The analysis of player gaming habits revealed that average users’ activity follows predictable patterns and fully aligns with human biorhythms and social responsibilities.

Most Popular Social Casino Games

The largest European social casino by the number of slot games, SpinArena.net, has a robust collection of over 3,000 games from almost 40 providers. Half of all gaming sessions are spent playing the top 15 games.

In SpinArena.net, the top 5 most popular games make up one-third of all games played. Like in traditional online casinos, slots are the most common choice among players. Certain popular games such as Gates of Olympus, Sweet Bonanza and Sugar Rush are favourites in both social and traditional online casinos.

Ously Games GmbH Founder Jochen Martinez comments: “This analysis perfectly illustrates how social casinos fulfil the same player needs as traditional casinos, offering a safer gaming experience. Combining gaming with social interactions provides a unique environment and neutralises financial risks. Players can enjoy activities like connecting with friends while playing their favourite games.”

Vitali Matsukevich, COO at SOFTSWISS, summarises: “Social casinos are part of the mega trend in the global entertainment industry, where player behaviour coincides with those in traditional online casino gaming. Anticipating social casinos’ evolution and integration with iGaming, SOFTSWISS partnered with Ously Games GmbH to present a new B2B software product – a comprehensive platform for social casinos.”

About SOFTSWISS

SOFTSWISS is an international technology company with over 15 years of experience in developing innovative solutions for the iGaming industry. SOFTSWISS holds a number of gaming licences and provides comprehensive software for managing iGaming projects. The company’s product portfolio includes the Online Casino Platform, the Game Aggregator with over 20,000 casino games, the Affilka affiliate platform, the Sportsbook Platform and the Jackpot Aggregator. In 2013, SOFTSWISS revolutionised the industry by introducing the world’s first Bitcoin-optimised online casino solution. The expert team, based in Malta, Poland, and Georgia, counts over 2,000 employees.

About Ously Games

Ously Games is a German enterprise, the provider of SpinArena.net, Europe’s largest social casino by number of slots. It boasts an extensive collection of over 3000 games from 40 renowned providers. With an annual turnover exceeding a million euros, Ously Games is driven by a team of 20 professionals.

The post Unveiling Social Casino Trends: Insights into Player Behaviour appeared first on European Gaming Industry News.

Latest News

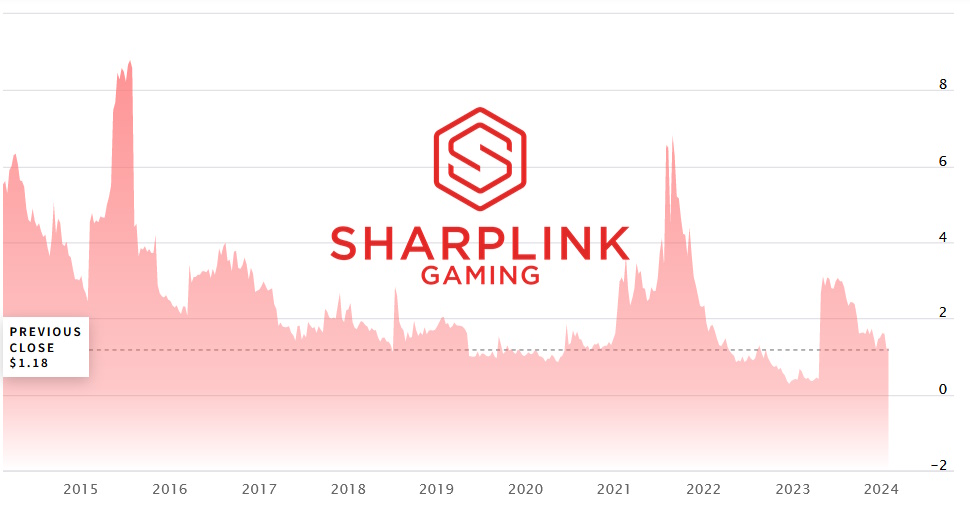

SharpLink Gaming Announces First Quarter 2024 Results and Provides Operational Update

SharpLink Gaming, Inc. (Nasdaq:SBET) (“SharpLink” or the “Company”), an online performance-based marketing company serving the U.S. sports betting and iGaming industries, today announced its first quarter financial results for the three months ended March 31, 2024, as reported in the Company’s Quarterly Report on Form 10-Q (“10-Q”) filed with the U.S. Securities and Exchange Commission (“SEC”) on Friday, May 17, 2024.

Commenting on the results, Rob Phythian, Chairman and CEO of SharpLink, stated, “2024 kicked off being marked by a pivotal quarter defined by the successful execution of a series of initiatives. We view each of these important milestones as critical first steps in achieving the strategic transformation of our Company, enabling us to ultimately win distinction as a leading pure-play online affiliate marketing company trusted by and relied upon by our U.S. sportsbook and global casino gaming partners.”

As previously announced, on January 18, 2024, SharpLink sold its Sports Gaming Client Services and SportsHub Gaming Network (“SHGN”) business segments to RSports Interactive, Inc. (“RSports”) for $22.5 million in an all-cash transaction. As a result, the historical results for these segments were reflected as discontinued operations in the Company’s consolidated financial statements included in the 10-Q.

Financial Highlights for the Three Months Ended March 31, 2024 Compared to Three Months Ended March 21, 2023

- Revenues from the Company’s continuing operations totaled $975,946 compared to $1,232,762.

- Net loss from continuing operations declined 18.4% to $1,760,811 compared to $2,157,183.

- Net income from discontinued operations, net of tax increased 2217% to $14,111,167 from a net loss from discontinued operations, net of tax of $666,563.

- Net income totaled $12,350,345, or $3.36 income per share on a fully diluted basis – up 537% from $2,823,746, or $1.01 loss per share.

For more detailed information on SharpLink’s first quarter 2024 financial performance, please refer to Form 10-Q filed with the SEC and accessible at sec.gov or on SharpLink’s website at sharplink.com.

First Quarter 2024 Business Highlights

- On January 18, 2024, completed sale of SharpLink’s Sports Gaming Client Services and SHGN businesses to RSports for $22.5 million in an all-cash transaction.

- Immediately following the sale, SharpLink used a portion of the proceeds from the sale to retire approximately $19.4 million, in aggregate, in outstanding debt obligations, thereby eliminating all interest-bearing debt on its balance sheet.

- On February 8, 2024, regained full compliance with Nasdaq Continued Listing Standards.

- On February 13, 2024, completed domestication merger with SharpLink Gaming, Ltd., changing from an Israel limited liability company to a Delaware corporation.

- In February, established new Board of Directors for SharpLink Gaming, Inc. with the appointments of Rob Phythian as Chairman and Leslie Bernhard, Obie McKenzie and Robert Gutkowski as new independent members of the Board.

Continuing, Phythian said, “Given our strengthened balance sheet; our highly engaged Board comprised of world class, accomplished business executives; and our shared commitment to a strategy that is expected to empower us to capitalize on potentially compelling growth opportunities in the sports, entertainment and media industries, SharpLink has great hopes for our Company’s future. We plan to continue to enhance our value proposition to our sportsbooks and casino operator partners, while also actively seeking opportunities to expand our iGaming affiliate marketing network into new U.S and international markets where online sports betting and casino gaming have been legalized. Moreover, we intend to continue executing our strategic transformation with clarity and focus, and in doing so, we hope to deliver strong, sustainable value creation for our fellow shareholders for many years to come.”

“Unlocking SharpLink’s next phase of growth with purpose and cost-discipline will be key to our long-term success and should provide us with greater agility as we build momentum and look to accelerate our growth prospects as 2024 unfolds. To help support our mission and continued strategic transformation, we have filed a registration statement on Form S-3 with the SEC and accompanying prospectus for an At-The-Market offering (“ATM”) which we may utilize to raise growth capital if and when market conditions permit. We have identified other measures that we may also pursue to optimize our assets and further strengthen the foundation on which we are building the ‘new’ SharpLink. Over the course of the next several months, I look forward to sharing many more details on our plans and future ambitions,” concluded Phythian.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy any securities of SharpLink, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

Latest News

Gaming Innovation Group – Minutes from Annual Meeting of Shareholders

The Annual Meeting of Shareholders in Gaming Innovation Group Inc. was held today, 22 May 2024, in Stockholm, Sweden. Shareholders representing 57.10% of the shares entitled to vote were present in person or by proxy.

The Annual Meeting approved the Company’s Annual Report for 2023.

The Annual Meeting resolved that the Board of Directors should consist of five members and resolved to re-elect Mikael Riese Harstad as Director of the Board and elect him as new Chairman, to re-elect Hesam Yazdi as Director of the Board, and to elect Cristina Romero de Alba, Mateusz Juroszek and Nicholas Batram as new Directors of the Board. It was further resolved to approve the proposal from the Nomination Committee for remuneration to the Board of Directors.

The Annual Meeting further resolved that the Nomination Committee shall consist of not less than three and not more than four members, to represent all shareholders, and be appointed by the three largest shareholders as at 31 August 2024.

Finally, the Annual Meeting resolved to reappoint REID CPAs LLP as auditors of the Company, and to give the Board of Directors authority to buy back already issued and outstanding shares in the Company as proposed in the Notice of Annual Meeting of Shareholders.

GiG Media and GiG Platform Boards

As part of the process to split the Company by distributing GiG Platform to the shareholders, the Company now have two separate board compositions. GiG Media will continue to operate under GiG’s current corporate structure, with GiG serving as its listed holding company. GiG Platform, currently operated as a subsidiary of GiG, will be spun off to GiG’s shareholders later this year. GiG Platform now has a board of directors consisting of Petter Nylander as chairman, along with Nicolas Adlercreutz, Mikael Riese Harstad, Hesam Yazdi, Tomasz Juroszek and Steve Salmon as ordinary board members.

The post Gaming Innovation Group – Minutes from Annual Meeting of Shareholders appeared first on European Gaming Industry News.

-

Asia7 days ago

Asia7 days agoFrom LatAm to Asia: Meet GR8 Tech at SiGMA Manila

-

Latest News7 days ago

Latest News7 days agoNetBet Casino Joins Forces with Yggdrasil

-

Latest News7 days ago

Latest News7 days agoGames Global and OROS Gaming add to acclaimed series with Magnificent Power Wolf Fire Spirit™

-

CGS Santiago7 days ago

CGS Santiago7 days agoPragmatic Play to Participate in CGS Santiago

-

Canada7 days ago

Canada7 days agoPlay’n GO announces partnership with Canadian operator Loto-Québec

-

Balkans6 days ago

Balkans6 days agoBulgarian President Approves Gambling Law Amendments

-

Asia6 days ago

Asia6 days agoIGT Showcases New Locally Attuned Link Games and Systems Innovations at G2E Asia 2024

-

Albert Bellavista CEO at Betsala7 days ago

Albert Bellavista CEO at Betsala7 days agoRelax Gaming enhances Latin American presence with Betsala partnership