penelitian kaitan inflasi n kebijakan Fed Fund Rate Conclusion This paper constructs Markov-switching models that estimate the probability of inflation returning to a high-variance, high-persistence regime similar to the 1970s and 1980s, and uses those models to generate prediction intervals around Federal Reserve Board staff forecasts of PCE price inflation. Not surprisingly, the model probabilities show the low-variance regime with a stable mean has governed the behavior of inflation since the 1990s, and as long as the probability of the high-variance, high-persistence regime remains very low, the model’s prediction intervals around one- and two-year ahead forecasts will be well-approximated by those computed from the distribution of forecast errors in the low-variance regime. The paper computes that distribution in the low-variance regime non-parametrically, and shows how to combine that non-parametric distribution with the parametric information from the Markovswitching model. If the model-based probability of the high-variance, high-persistence regime 20For simplicity, estimated shock values are left unrevised. 29 were to increase substantially, the width of the prediction intervals, particularly those using the far tails of the mixture distribution, would widen substantially as well. Additional results in the paper that may be innovations to some information sets include: 1. Over the full 1948-2014 sample, time series evidence strongly suggests the four-quarter inflation measures examined here follow MA(2) processes in differences. On average, about half of the typical innovation to the inflation process reverses after two years, with reversals following large innovations to oil and other commodity prices contributing importantly to this result. 2. Over the last 20 years of the sample, a wide range of evidence suggests there is no random walk component to inflation of any quantitative significance for forecasting purposes. Estimating the probability that a random walk reappears in the inflation process, is, of course, one of the main goals of the paper. 3. Survey measures of long-run inflation expectations, often used to make inferences about whether the current low-variance, low-persistence inflation regime is likely to continue, were unavailable in the late 1960s during the last transition out of such a regime, and were comparatively slow to recognize the transition into the current low-variance regime in the 1990s. The Markov-switching models were much faster in recognizing that regime transition in the 1990s, so they may provide more accurate and timely inferences on regime transitions going forward as well. 4. The tail risks to inflation over the next 5 or 10 years, as measured by financial market derivatives, collapsed in 2014. After that collapse, those measures of tail risks are now much closer to those estimated using the Markov-switching model. 30 5. The Romer and Romer (2000) result that Federal Reserve Board staff forecasts have outperformed their private sector counterparts has not held out of sample, at least for the four-quarter growth rates targeted by the forecasts of FOMC members. Since 1999, Board staff forecasts have been less accurate (as measured by RMSE) than forecasts from both the private sector and the Markov-switching models. The distribution of Board staff forecast errors has taken on a noticeable asymmetry as well: the forecasts at one end of the error distribution, those that were too low, missed by much more than the forecasts at the other end of the distribution that were too high. This asymmetry is largely idiosyncratic to the Board staff—private-sector forecast error distributions or those from impartial models like a random walk or a constant exhibit much less asymmetry—and may stem either from consistent misjudgments about the likelihood that low inflation would persist or from a desire by Board staff to justify loose monetary policy, particularly in 2003, 2004, and in the aftermath of the Great Recession.

bloomberg:

janet yellen Nov 4, 2015:

Inflation Expectation

“If we were to move, say in December, it would be based on an expectation, which I believe is justified, that — with an improving labor market and transitory factors fading — that inflation will move up to 2 percent,” Yellen said.

Michael Gapen, chief U.S. economist at Barclays Capital Inc. in New York, said Yellen’s comments on inflation served to deflect an argument outlined in October by Fed Governor Lael Brainard that the central bank should wait to see movements in inflation before raising rates.

Yellen rejected that argument in favor of a “forecast-based decision,” Gapen said.

“The divide in the committee was essentially over whether they should move in advance of inflationary pressure or wait to see it,” he said. “This clearly says the forecast-based side won that argument.”

congress wants:

Janet Yellen can stay in God’s good graces by waiting until springtime to raise interest rates, Representative Brad Sherman told the Federal Reserve chair on Wednesday.

“God’s plan is not for things to rise in the autumn, as a matter of fact, that’s why we call it fall, nor is it God’s plan for things to rise in the winter, through the snow,” Sherman, a Democrat from California, told Yellen at a hearing of the House Financial Services Committee. “God’s plan is that things rise in the spring. And so if you want to be good with the Almighty, you might want to delay until May.”

Later Wednesday, Sherman wrote on his Twitter account, “Don’t actually think God has an opinion on monetary policy, but if She did, She would agree that the FOMC shouldn’t increase rates in winter.”

At the hearing, Sherman more seriously went on to say that he’s worried about the risks if the Fed lifts off too early and then has to return to zero, among other issues. While his comments were a little more colorful than the typical rationale for postponing liftoff, they underline an important point: Yellen is coming under congressional and political pressure as the Fed inches closer to raising rates.

Yellen said earlier Wednesday that the U.S. economy is performing well and December would be a “live possibility” for a rate increase, though no decision has been made. Rates have been near-zero since 2008 as the Fed tried to encourage economic activity to drive down unemployment and pull inflation closer to its 2 percent goal.

Lobbying Fed

As the central bank prepares to take its foot off the gas, it’s seeing push-back from politicians, non-governmental organizations and interest groups. American Principles Project, a Washington-based non-profit pushing for an increase, held a conference on the sidelines of the Kansas City Fed’s Jackson Hole, Wyoming, summit this year featuring prominent conservative speakers. Fed Up, a coalition of community groups organized by the Center for Popular Democracy in Washington, was also present — but urging for rates to stay low.

While Yellen and her Fed colleagues spend time talking to politicians and groups interested in the central bank’s actions, they’re legally granted independence when setting monetary policy. So Sherman can warn Yellen about Divine wrath, but in the near term, he can’t do much to make sure that she heeds that advice.

marketwatch (04th Nov 2015): U.S. stocks ended Wednesday’s session slightly lower, taking a pause after two straight days of gains.

The main indexes retreated as Federal Reserve Chairwoman Janet Yellen hinted that a 25 basis point rate hike in December would not derail the economy or the housing market. New York Fed President William Dudley also struck a hawkish tone, saying he agreed with Fed Chairwoman that a December rate hike is a live possibility.

Some analysts said the moderate pullback on Wednesday was a function of October’s outsize gains — the biggest monthly climb since 2011.

The S&P 500 fell 7.46 points, or 0.4%, to 2,102.33, with eight of its 10 main sectors closing lower. Energy and consumer discretionary sector stocks were the biggest decliners, while utilities and tech stocks rose modestly.

The Dow Jones Industrial Average fell 50.57 points, or 0.3%, to 17,867.58. The Nasdaq Composite ended the day down 2.65 points, or less than 0.1%, at 5,142.48.

Yellen’s hawkish comments affected traders’ rate-hike expectations, with the odds of a rate hike in December moving to 60% from about 52% on Tuesday, according to the CME Group Fed Watch tool. The yield on the 2-year Treasury note, which is the most sensitive to the prospect of a rate hike, spiked to 0.8%, its highest level in four years.

“Janet Yellen has been signaling a rate hike for a year and markets have already priced in the possibility. Let’s not forget that markets actually rallied after the last Fed meeting when the statement suggested rates would rise in December,” said Bruce Bittles, chief investment strategist at RW Baird & Co.

“We live in a two-tiered economy where manufacturing is slumping but the services sector, which is a much bigger part of the economy is doing well. The slow-growing economy is still the best option for the stock market,” Bittles said.

In economic news, Wednesday’s data came in mixed. A report on private-sector employment showed 182,000 jobs were created last month, while September gains were cut, according to the Automatic Data Processing Inc. Economists look at the ADP report to get a feeling of the official job gains data due on Friday.

“If [jobs] numbers come in near expectations, look for traders to become more convinced that the Fed will finally begin the interest rate normalization process in December,” wrote James M. Meyer, chief investment officer at Tower Bridge Advisors in a note to investors.

Meanwhile, the Institute for Supply Management’s services index rose by more than expected in September to the highest level in three months. The gap between the ISM services and manufacturing indexes is the largest in over 14 years.

The U.S. trade deficit fell in September, but the sharp decline is unlikely to last and give the economy a pop.

The S&P 500 has rallied 13% in just five weeks, noted Michael O’Rourke, chief market strategist at JonesTrading, in a note to investors.

“Most would agree the fundamental situation has not changed much, with exception of a handful of well received earnings reports, which is really no different than any other quarter,” he said.

O’Rourke added that technology, health-care and consumer-discretionary sectors make up more than half of the $1.9 trillion in market capitalization gained during this rally. “It is probably not a good sign if the market is relying heavily on the same narrow leadership,” he said.

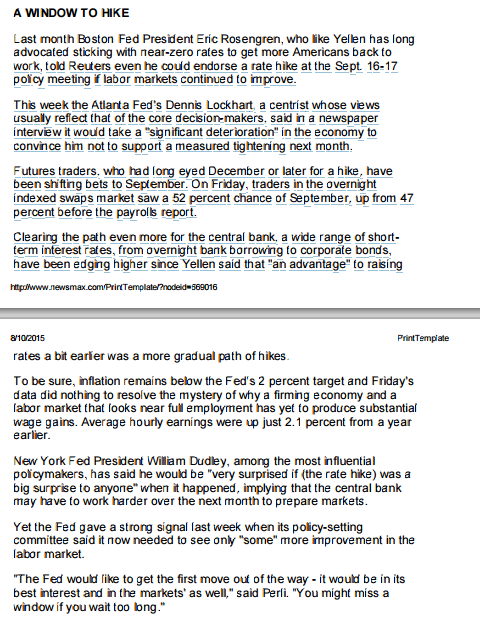

Monetary policymakers in the US are looking for stronger signs of an improving economy before deciding to hike interest rates for the first time in nine years.

Federal Reserve policymakers said the conditions for a rate hike were now “approaching” but were looking for further signs of a rise in inflation, in the latest set minutes from their July policy meeting.

“Almost all members” of the committee “indicated that they would need to see more evidence that economic growth was sufficiently strong” before voting in favour of rate hike, said the transcript of a cautious set of minutes.

Only one policymaker was ready to vote for a rate hike last month, while a number of others “viewed the economic conditions for beginning to increase the target range for the federal funds rate as having been met or were confident that they would be met shortly”.

• Bank of England or Federal Reserve: Who will move first on interest rates?

Financial markets are now pricing in a 40pc probability that rates will be hiked from a record low range between 0pc and 0.25pc at the committee’s (FOMC) next meeting in mid-September. The FOMC however made few indications of the timing of the lift-off.

The minutes were released as consumer prices rose by a modest 0.1pc last month. The uptick in inflation was slightly lower than analyst forecasts of 0.2pc , and will give the Federal Reserve “pause for thought” over a September rate rise, said Paul Ashworth, chief US economist at Capital Economics.

“The decision is finely balanced. With underlying price inflation and wage growth still muted, a case can also be made for waiting,” said Mr Ashworth.

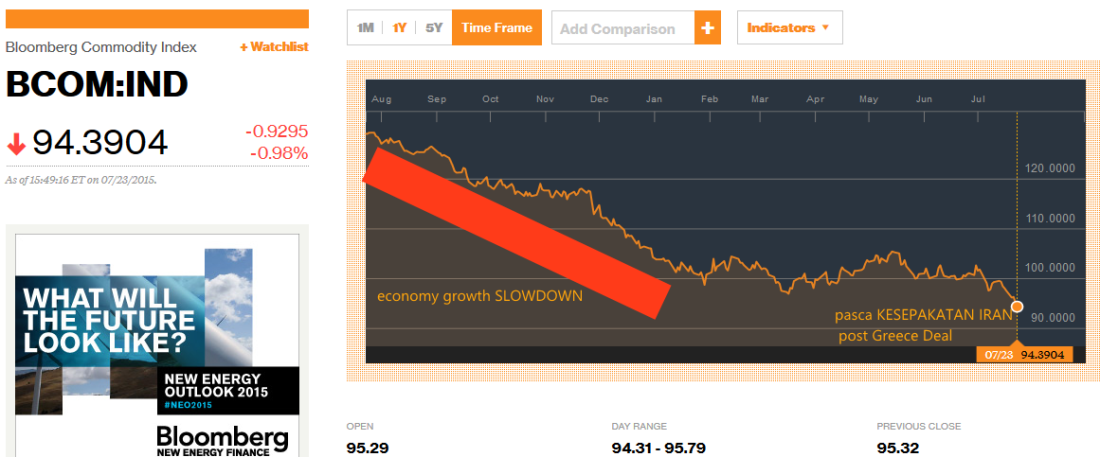

A measure of core inflation, which strips out volatile elements such as food and energy, rose by 1.8pc in the year to July. But world’s largest economy could still fall into deflation in the coming months, said Josh Mahoney of IG.

“The impact of multiyear lows in commodity prices and a likely continued depreciation of the yuan” could drive the US economy back into negative prices, he said.

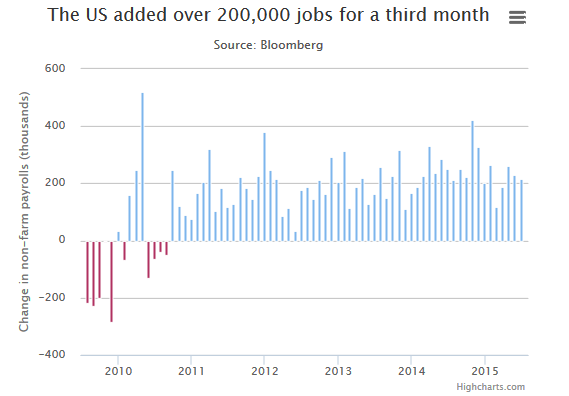

With the Fed keeping a close eye on the labour market, robust job creation could also edge it to move towards a normalisation of monetary policy. The US economy added 215,000 jobs in July, with the minutes noting that labour market improvements are nudging the FOMC towards a rate hike sooner rather than later.

http://cloud.highcharts.com/embed/isebew

The July meeting took place before recent moves by the People’s Bank of China to devalue the renminbi, sparking a fresh round of stock market volatility. The minutes revealed that fears of an “adverse spillovers from slower economic growth in China raised some concerns”.

10:18 am ET

Jun 1, 2015

economics

Inflation Misses Fed’s 2% Target for 36th Straight Month

It’s been three years since U.S. inflation hit the Federal Reserve‘s 2% target, according to new data from the Commerce Department.

The personal consumption expenditures price index, the Fed’s preferred inflation gauge, rose just 0.1% in April from a year earlier, the lowest level since October 2009 and a little softer than the 0.3% reading in February and March.

April 2012 was the last time the inflation rate was on target. That’s the longest such stretch of sub-2% inflation since the 1960s.

Excluding the volatile food and energy categories, prices climbed 1.2% in April from a year earlier, a slight downshift from the 1.3% reading the prior four months.

Such low inflation complicates the Fed’s plans to start raising interest rates. The central bank’s dual mandate calls for price stability–in this case 2% inflation–and maximum employment. While the labor market appears healthy, low oil prices, a strong dollar and tepid global demand are all holding down prices.

“It won’t be current inflation that prompts the first Fed hikes, it will be the tightness of the labor market and the signal it sends about future inflation risk, given the extraordinarily easy stance of policy,” Ian Shepherdson, chief economist at Pantheon Macroeconomics, said in a note to clients.

Commodity Prices and Inflation: Evidence From Seven Large Industrial Countries

James M. Boughton, William H. Branson, Alphecca Muttardy

NBER Working Paper No. 3158

Issued in November 1989

NBER Program(s): EFG ITI IFM

This paper examines the relationships between movements in primary commodity prices and changes in inflation in the large industrial countries. It begins by developing a two-country model in order to examine the theoretical effects of monetary, fiscal, and supply-side disturbances on commodity and manufactures prices and on exchange rates.

It is shown that if monetary shocks dominate, then commodity prices should lead general price movements, and the level of commodity prices should be correlated with the general inflation rate.

Non-monetary shocks generally weaken these relationships, but such disturbances may cancel out for broad indexes covering a wide range of commodities.

Country-specific commodity price indexes are developed for the major industrial countries. The weights assigned to different commodities vary substantially across countries. Nonetheless, when the indexes are expressed in a common currency, they tend to be highly correlated over time, except when sharp movements occur in certain commodity prices. The major source of contrast across countries in the behavior of the indexes derives from exchange rate movements.